Summary

In an era where efficiency and personalization rule the banking experience, voice bots are emerging as pivotal tools, revolutionizing the way banks engage with their customers. These AI-driven assistants are not just augmenting customer service; they’re revolutionizing it by providing round-the-clock support and significantly enhancing operational efficiencies. As financial institutions strive to enhance customer experience and stay competitive, voice bots are becoming an essential tool for success.

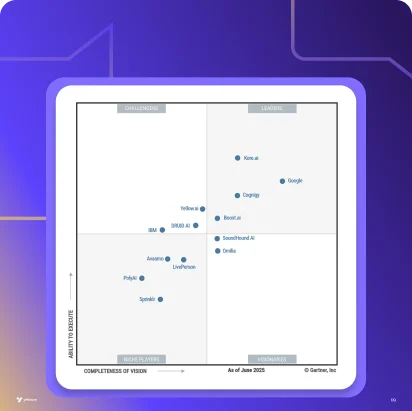

According to a Cognizant survey, customer behavior is shifting, with 80% of the 1,400 respondents indicating that voice AI has a game-changing impact on banking. This blog delves into the role of voice bots in banking, exploring their benefits, key features, and the future of banking automation. This blog will explore how voice bots optimize customer service and streamline banking operations, illustrating their growing indispensability in modern financial ecosystems. We’ll delve into the multifaceted benefits of voice bots, including their capacity to boost customer satisfaction, reduce costs, and drive continuous innovation in the dynamic world of banking.

Related must-reads:

- AI Voice Bot – The complete guide to voice chat

- What are voice bots and their use-cases for different industries?

- Voice AI – What is it and benefits of voice AI for business

- How voice bots are transforming customer service in 2024?

Voice bots in banking 101

Definition of voice bots in banking:

These are sophisticated AI-powered systems designed to simulate human conversation, enabling customers to perform banking transactions and inquiries through voice commands. Advanced AI technologies such as speech recognition, natural language processing (NLP), and machine learning (ML) enable voice bots to understand and respond to human requests through conversational interactions. By converting spoken words into text, identifying user intent, and providing appropriate responses, voice bots offer a seamless, human-like interaction experience.

The role of AI and NLP in banking:

These technologies allow voice bots to handle customer inquiries efficiently, providing quick and accurate information on demand. AI helps analyze large volumes of data to enhance decision-making and customer interaction, while NLP allows voice bots to interpret human speech, enabling them to respond intelligently and contextually. That’s not all, AI-driven voice bots continually learn from interactions, improving their accuracy and personalization. This ensures higher customer satisfaction as financial institutions can deliver prompt and reliable service.

Advantages of implementing voice bots in banking

Integrating voice bots in the banking sector brings numerous advantages that transform how financial institutions interact with their customers. From enhancing customer service to boosting operational efficiency and ensuring compliance, voice bots offer a spectrum of benefits that significantly elevate both the quality of service and customer satisfaction. Here, we explore the key benefits of implementing voice bots in the banking sector.

Key benefits of implementing voice bots in the banking sector

- Compliance and security

- Enhanced customer service and support

- 24/7 Availability and instant responses

- Cost reduction and operational efficiency

- Personalization and multilingual customer experience

1. Compliance and security

In the highly regulated banking sector, compliance and security are paramount. Voice bots are designed to comply with regulatory requirements, ensuring that customer interactions and transactions adhere to industry standards. They can monitor and record conversations, providing an audit trail that is essential for compliance purposes. Furthermore, advanced security features such as voice biometrics enhance the authentication process, reducing the risk of fraud and unauthorized access. By implementing robust security measures, voice bots help maintain customer trust and protect sensitive information, thereby upholding the integrity of banking operations.

2. Enhanced customer service and support

Voice bots revolutionize customer service by efficiently handling routine inquiries such as account updates and billing questions, allowing human agents to focus on complex issues that require empathy and deep problem-solving skills. These AI-powered tools utilize data from past interactions to provide context-aware and personalized responses, significantly improving the relevance and efficiency of the support provided. Additionally, when issues exceed their capabilities, voice bots seamlessly escalate them to the appropriate human agent, equipped with detailed, pre-analyzed data. This not only shortens resolution times but also boosts customer satisfaction by ensuring that customers feel understood and valued throughout their interactions.

3. 24/7 Availability and instant responses

In today’s globalized world, customers are often always on and so must banking services. One of the most significant advantages of voice bots in banking is their ability to offer 24/7 customer support, allowing customers to receive immediate assistance at any time. Unlike human agents, voice bots are always available, providing instant responses regardless of the time of day. By promptly addressing inquiries, these bots prevent customer frustration associated with long waits, ensuring a smoother and more satisfying banking experience. This instant support mechanism reinforces the bank’s reputation as a responsive and customer-centric institution.

4. Cost reduction and operational efficiency

Voice bots extend beyond labor cost savings by optimizing the allocation of human resources, enabling banks to redirect funds toward enhancing customer relationships and driving innovation. These automated systems manage vast volumes of interactions simultaneously, making them highly scalable. They can adeptly handle fluctuations between peak and non-peak volumes without additional infrastructure or investment, thus preventing unnecessary expenditures. This capability not only bolsters the bottom line but also allows banks to expand their services efficiently, scaling operations without a corresponding spike in costs. This strategic scalability ensures that banks can maintain service continuity and high customer satisfaction levels without compromising on operational costs.

5. Personalization and multilingual customer experience

Voice bots powered by AI and NLP can deliver highly personalized customer experiences. They can remember customer preferences, transaction histories, and previous interactions, allowing them to provide tailored responses and recommendations. Most importantly, voice bots can significantly improve accessibility and quality of experience by seamlessly switching between preferred languages and dialects to ensure a smooth interaction. This capability ensures that banks can serve a diverse customer base without incurring high costs or extended implementation times typically associated with multilingual staffing.

Use cases of voice bots in banking

Voice bots in banking streamline customer service by handling tasks like balance inquiries, transaction history, fraud alerts, and loan applications. They enhance efficiency, reduce wait times, and provide 24/7 support.

1. Account management

Voice bots are incredibly useful for account management in banking. Customers can seamlessly check their account balance, retrieve transaction history, transfer funds, and update personal information using voice commands. Instead of navigating complex menus or waiting for an available agent, they interact with the bot for instant service.

Voice bots can securely access account information and complete transactions, ensuring the security of sensitive data. Additionally, they provide real-time updates and notifications, such as low balance alerts or large transactions, enhancing the overall customer experience by offering convenient, efficient, and secure account management services around the clock.

2. Customer support

Voice bots are transforming customer support in banking by handling common inquiries and boosting fraud detection. Customers can quickly get answers to routine questions about services or fees without waiting for a human agent. This instant, accurate assistance improves customer satisfaction.

Voice bots also enhance security by monitoring account transactions in real-time and spotting unusual activities. When potential fraud is detected, they alert customers immediately and guide them through securing their accounts. This proactive approach addresses customer concerns promptly and ensures their accounts remain safe. By combining efficient service with robust security, voice bots are becoming essential in delivering exceptional customer support in banking.

3. Loan and mortgage processing

Voice bots make loan and mortgage processing more straightforward and convenient for customers. Instead of waiting on hold or visiting a branch, customers can easily check the status of their applications using voice commands. This means real-time updates and less anxiety about the approval process.

Voice bots also help with document submission and tracking. They guide customers on what documents are needed, allow secure submission, and track progress. By automating these steps, voice bots cut down on paperwork and speed up the process. This makes the experience smoother and more efficient, making it easier for customers to manage their loans and mortgages.

4. Financial advice and planning

Voice bots are beneficial for personalized financial advice and planning. Instead of navigating complex financial jargon, customers can simply ask the bot for advice on investments, savings, or retirement planning. The bot analyzes their financial situation and preferences to offer relevant and easy-to-understand recommendations, making financial planning straightforward and approachable.

Voice bots also provide practical budgeting and savings tips. Customers can get instant advice on managing their money better, setting realistic savings goals, and tracking progress. These bots keep users on track with helpful tips and reminders about their financial health. This personalized, real-time support makes it easier for customers to make smart financial decisions and achieve their goals.

Other miscellaneous use cases of voice bots in banking

- Voice authentication: Implementing voice biometrics to verify customer identity swiftly and securely, which enhances security and convenience in transactions.

- Promotions and offers: Utilizing voice bots to inform customers about relevant offers, promotions, or new services tailored to their banking behaviors and preferences.

- Accessibility enhancements: Highlighting how voice bots cater to customers with disabilities by providing an alternative way to access banking services, enhancing inclusivity.

- Multilingual support: Discussing the capability of voice bots to engage customers in various languages, reflecting the bank’s commitment to serving a diverse clientele.

- Customer education: Using voice bots for financial literacy by explaining banking products, terms, and best practices in a user-friendly manner.

Latest Yellow.ai customer stories

Future trends of voice bots in banking

The future of voice bots in banking is brimming with exciting possibilities, driven by the rapid advancements in AI technology. As AI continues to evolve, voice bots are expected to become more sophisticated, providing even more natural and intuitive customer interactions. Enhanced natural language processing (NLP) will allow these bots to understand and respond to complex queries with greater accuracy and context awareness, making customer interactions smoother and more efficient. Voice bots will likely offer personalized financial advice and proactive alerts, helping customers stay informed about their financial health. The role of voice bots in fraud detection will also expand as they become more adept at identifying and mitigating risks in real-time.

In the coming years, voice bots will integrate more deeply into banking systems. As AI and machine learning (ML) technologies advance, voice bots will continuously improve their ability to learn from customer interactions and provide increasingly personalized and relevant responses. These advancements will make voice bots indispensable, offering customers seamless, secure, and highly customized services.

Conclusion

Adopting voice bots in banking is a big step in making banking more innovative and customer-friendly. These bots provide a seamless, secure, and hands-free experience for customers. With advanced AI technologies like NLP and ML, voice bots offer 24/7 support, handle routine questions, and give personalized financial advice while cutting costs. As AI improves, voice bots will play an even more significant role, ensuring every interaction is accurate and helpful.