Executive summary

The banking industry is rapidly evolving, and the mantra for success is reinventing customer service. This blog explores the world of customer service in banking, spotlighting why it’s more than just a support function but a pivotal factor in shaping customer loyalty and business growth. From analyzing what constitutes outstanding customer service in banking to the importance of personalized, efficient interactions, this blog offers ten applied strategies. Each of these strategies is illustrated with real-world examples.

Introduction

The landscape of banking has undergone a seismic shift, with customer service becoming the cornerstone of the industry’s evolution. Banking is no longer confined to the walls of a branch. The focus has dramatically shifted towards how banks can create memorable and positive customer experiences. It’s a digital-first world where banking interactions are increasingly screen-based. It is a transition accelerated by recent global events. Capgemini research reveals that 48% of customers believe their banking relationships need to be more effectively integrated with their daily activities, while 52% of customers find banking onerous.

Convenience and expectations merge in today’s digitized era, and banks are no longer mere financial institutions. Instead, they are crucial players in their customers’ daily lives. Every interaction in the banking industry today is an opportunity to solidify trust, foster loyalty, and personalize the banking journey.

Imagine a scenario where your bank is not just a place for monetary transactions but a hub of seamless, intuitive, and responsive interactions. It is where every customer feels valued and understood. This blog aims to be your navigator through the nuanced waters of customer service in banking. We’ll dissect not just the ‘what’ and ‘why’ but the ‘how’ of transforming customer service from a mere function into a defining feature of your bank’s identity. Read on to discover insights that could transform your bank’s approach to customer service, making it an epicenter of excellence in the financial world.

Related must-reads:

- Customer service trends to watch in 2024

- How to automate customer support?

- 6 Examples of conversational AI in banking

- 10 Bad customer service examples (How to fix them)

What is excellent customer service in banking?

The world of banking is intricate. Here, excellent customer service transcends traditional expectations. It’s an artful mix of personalized attention, swift problem-solving, and anticipatory service that makes each customer feel uniquely valued. It is a fast-paced financial landscape where technology and human interaction intertwine, and defining excellent customer service becomes both a challenge and an opportunity for banks. Banks cannot limit it merely to meeting customer needs. That is because exceptional customer service in banking is about understanding and predicting them, fostering a relationship where customers feel seen, heard, and appreciated.

Banks that prioritize customer experience achieve 10-15% revenue increase and 20% customer satisfaction growth.

Excellent customer service in banking revolves around personalized financial solutions. It’s about crafting experiences that resonate on a personal level. For instance, customers struggling with mortgage options don’t just need rates. They need guidance, empathy, and a solution that aligns with their life goals. Here, excellence lies in making the complex seem effortless, turning daunting financial decisions into manageable, clear paths. Banks that excel in this sphere use a mix of innovative technology and human insight to create a service that’s efficient and also empathetic.

The impact of this customer-centric approach is profound. When customers feel their bank understands their needs, they develop a sense of loyalty and trust. This conviction is pivotal in today’s banking sector, where a single negative experience can prompt customers to switch banks. Therefore, excellent customer service in banking is a strategic asset, a differentiator that sets a bank apart in a market where products and services are increasingly commoditized. By emphasizing customer service excellence, banks can retain their existing customer base. Likewise, they can attract new clients through positive word-of-mouth and a reputation for reliability and understanding.

Transform your customer service today with Yellow.ai

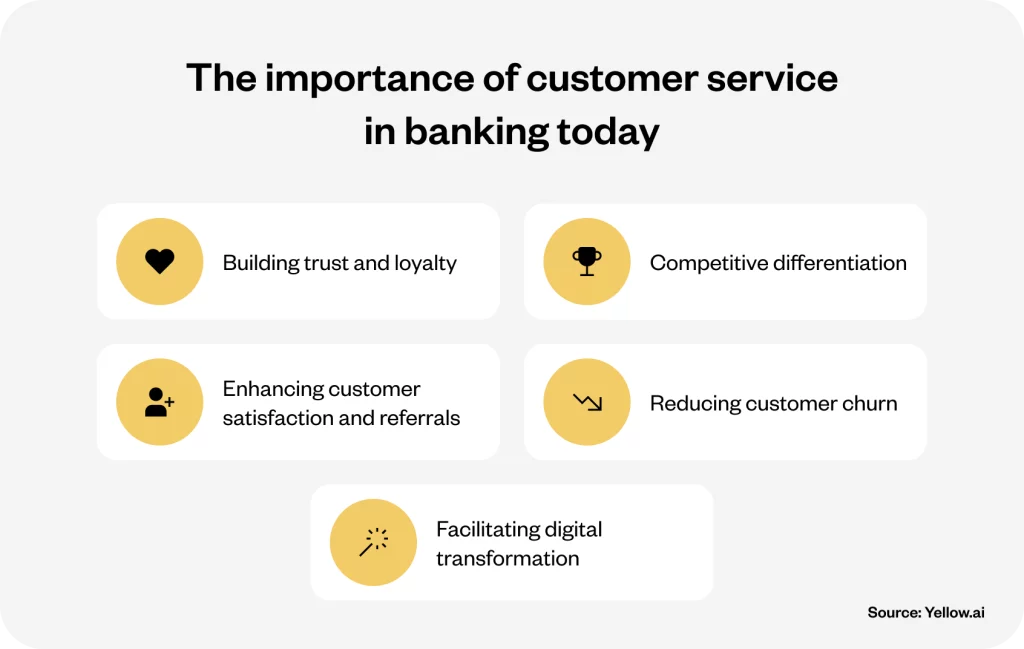

The importance of customer service in banking today

Customer service in banking has become more than a necessity. Today, it’s a powerful tool that shapes the identity and success of financial institutions. Since banking transcends mere transactions, the quality of customer interactions can make or break a bank’s reputation. Let’s understand why excellent customer service is crucial in the banking sector today.

1. Building trust and loyalty

Trust in the banking industry is a currency as valuable as the funds it manages. Quality customer service is a critical ingredient in building this trust. When customers receive consistent, empathetic, and efficient service, their confidence in the bank solidifies. This trust translates into loyalty, with customers less likely to switch to competitors.

For instance, a customer whose issues are resolved swiftly and satisfactorily feels a sense of belonging. Such customers are more likely to use additional banking services.

Banks can foster trust and loyalty by ensuring that customer service teams are well-trained, equipped with the necessary tools, and empowered to make customer-centric decisions. The focus should be on creating a culture where every interaction is an opportunity to strengthen the customer-bank relationship.

2. Competitive differentiation

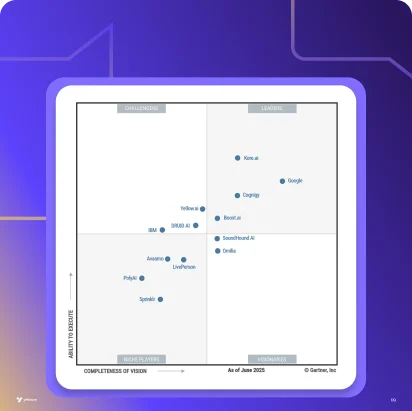

The banking sector is fiercely competitive, and customer service can become a key differentiator. Banks excelling in this department stand out in a sea of comparable financial products and services. By prioritizing customer service, banks can differentiate themselves in the quality of their products and the value they place on their customers.

Implementing innovative solutions like AI-driven chatbots for routine inquiries or personal financial management tools adds value to customer interactions. These solutions should be aligned with the bank’s core values and brand, ensuring a consistent and distinctive customer experience.

Related read: Why do companies need to enhance customer experience?

3. Enhancing customer satisfaction and referrals

Satisfied customers are the best advocates for a bank. When a bank exceeds customer expectations, it retains these customers and also turns them into promoters. A delighted customer is more likely to recommend the bank to friends and family. That can extend the bank’s reach and reputation.

Banks can enhance customer satisfaction by personalizing services and being proactive in addressing customer needs. For example, offering tailored financial advice based on individual customer profiles can significantly boost satisfaction levels.

4. Reducing customer churn

Customer churn poses a real challenge in the dynamic world of banking. Often, it’s not just the financial offerings but the quality of service that determines whether a customer stays or moves on. Banks have a golden opportunity to curb this churn by elevating their customer service game. It’s not just about firefighting problems as they arise; it’s about foreseeing potential issues and nipping them in the bud. This proactive approach in customer service can transform a customer’s banking journey from satisfactory to exceptional.

Formula:

Customer churn rate = (No. of churned customers during the period / Total number of customers at the start of the period) * 100

To tackle customer churn effectively, banks need to invest in their most valuable asset – their customer service teams. Regular training programs that focus on empathetic communication and problem-solving skills are essential. Additionally, leveraging the power of technology like predictive analytics can give invaluable insights into customer behavior and preferences. This foresight enables banks to offer personalized solutions, addressing customer needs even before they become apparent, thus significantly reducing the likelihood of customers switching to competitors.

Related read: 12 Customer service metrics to measure in 2024

5. Facilitating digital transformation

Digital transformation is reshaping the banking industry. In this transformation, customer service is crucial. Customers expect seamless digital experiences, and banks need to ensure that their digital channels are as personable and efficient as in-person services.

For instance, integrating digital channels like mobile banking apps with personalized customer service features can enhance the overall customer experience. This integration shows customers that the bank is not only technologically advanced but also customer-focused.

Related read: How to personalize customer experiences at scale

10 ways to improve customer service in banking

Enhancing customer service in the banking sector is pivotal to retaining a competitive edge. Here are ten transformative strategies to improve customer service in banking today.

1. Track complete customer interactions

Tracking complete customer interactions means having a comprehensive view of each customer’s journey. It’s essential to capture every touchpoint, from online banking logins to in-branch visits. This holistic perspective allows banks to understand customer behaviors and preferences fully.

Related read: How Can Customer Journey Maps Improve CX?

By tracking interactions, banks can tailor services to individual needs, predict future requirements, and proactively address potential issues. Implementing CRM systems and analytics tools can help banks effectively track these interactions. For example, a CRM tool can capture a customer’s call history, branch visits, and online banking activities, providing valuable insights into their banking habits.

Ways to implement the strategy:

- Utilize CRM systems to record all customer interactions.

- Analyze data to understand customer behavior and preferences.

- Use insights to tailor customer interactions and improve service quality.

2. Offer instant support

In today’s fast-paced world, customers expect immediate assistance. Banks need to provide real-time support through various channels like chat, phone, or in-person. Instant support enhances customer satisfaction and reduces frustration. Technologies like live chat, AI chatbots, and 24/7 helplines play a crucial role. For instance, integrating live chat on a banking website allows customers to get immediate answers to their queries.

Related reads:

- Build your AI chatbot in minutes – no coding, no training required

- What is live chat? The definitive guide for businesses

- Chatbot vs live chat: Which is better for customer service?

Ways to implement the strategy:

- Implement live chat options on digital platforms.

- Train staff to provide efficient and effective support.

- Utilize AI chatbots for handling basic queries.

3. Customize the customer experience

Personalization is key in banking. Tailoring services and communication to individual customer preferences can significantly enhance the banking experience. Personalized experiences foster loyalty and increase customer engagement. Banks can use data analytics to understand customer preferences and customize their services accordingly. For example, personalized financial advice based on a customer’s spending habits can be very impactful.

Ways to implement the strategy:

- Use data analytics to understand customer preferences.

- Personalize communication and offers based on customer history.

- Create segmented marketing strategies for different customer groups.

Pelago Transforming Customer Experience with Yellow.ai’s Generative AI-powered Virtual Assistant!

4. Utilize generative AI bots for banking

Generative AI bots can handle routine inquiries efficiently, taking the burden off human agents for more complex issues. AI bots can improve efficiency and customer satisfaction. They can handle basic inquiries like account balance checks or transaction queries. Implementing AI bots that can learn and adapt to customer queries is beneficial.

Related read: Chatbots in Banking – Benefits & potential Use Cases

Ways to implement the strategy:

- Deploy AI bots for basic inquiries and transactions.

- Ensure seamless handoff to human agents for complex issues.

- Continuously update AI algorithms based on customer interactions.

5. Build a seamless omnichannel presence

A seamless omnichannel presence ensures a consistent and unified customer experience across all banking channels, be it online, mobile, or in-branch. This strategy improves the customer experience by providing them with multiple, interconnected ways to interact with their bank. For example, a customer starts a transaction on a mobile app and completes it in a branch.

Related read: A Guide on Omnichannel Customer Engagement

Ways to implement the strategy:

- Integrate services across online, mobile, and physical channels.

- Maintain uniformity in messaging and branding across all channels.

- Use customer feedback to improve the omnichannel experience.

6. Enhance training in interpersonal skills

Interpersonal skills are critical, especially when handling sensitive financial matters. Training staff in communication, empathy, and problem-solving is crucial. Skilled staff can better understand and meet customer needs, leading to increased satisfaction. Role-playing exercises and workshops can be effective training tools.

Related read: 15 Key customer service skills (How to develop them)

Ways to implement the strategy:

- Regular training programs on empathy, communication, and problem-solving.

- Role-playing exercises to simulate real customer interactions.

- Feedback and coaching to continuously improve skills.

7. Establish a self-service knowledge repository

A self-service knowledge repository allows customers to find answers to their queries without contacting customer service directly. This approach empowers customers and reduces the workload on customer service teams. A well-organized FAQ section on the bank’s website is a good example.

Related read: Examples of customer self-service

Ways to implement the strategy:

- Develop an extensive FAQ section on digital platforms.

- Create tutorials and guides for everyday banking tasks.

- Regularly update the repository based on customer queries and feedback.

8. Gather feedback from customers

Gathering feedback is crucial for understanding customer satisfaction and areas for improvement. Feedback helps banks to tailor their services to meet customer needs more effectively. Surveys and feedback forms post-interaction are common methods.

Related read: Types of customer analytics and their benefits

Ways to implement the strategy:

- Implement feedback forms and surveys post-interaction.

- Analyze feedback for patterns and areas of improvement.

- Act on feedback to make necessary changes in services.

9. Refresh the online banking experience

With more customers banking online, it’s essential to provide an intuitive, user-friendly digital experience. Online banking is used by 84% of users, according to Deloitte research. A refreshing online experience can increase customer satisfaction and engagement. It might include a user-friendly interface, easy navigation, and personalized dashboards.

Ways to implement the strategy:

- Regular updates to the online banking interface for usability and accessibility.

- Incorporate customer feedback in designing the user experience.

- Ensure security and privacy in all online transactions.

10. Employ relevant data for insights

Using data analytics provides insights into customer behaviors, preferences, and needs. Data-driven insights can guide decision-making and strategy development. For example, analyzing spending patterns can help banks offer relevant financial products.

Ways to implement the strategy:

- Utilize data analytics tools to gather and analyze customer data.

- Implement predictive modeling for personalized product offerings.

- Use insights for strategic decision-making and service enhancements.

Examples of excellent customer service in banking

Innovative solutions powered by advanced technology are transforming customer service in the banking sector. Let’s explore two real-world examples where leading financial institutions enhanced their customer service experience significantly with the help of Yellow.ai.

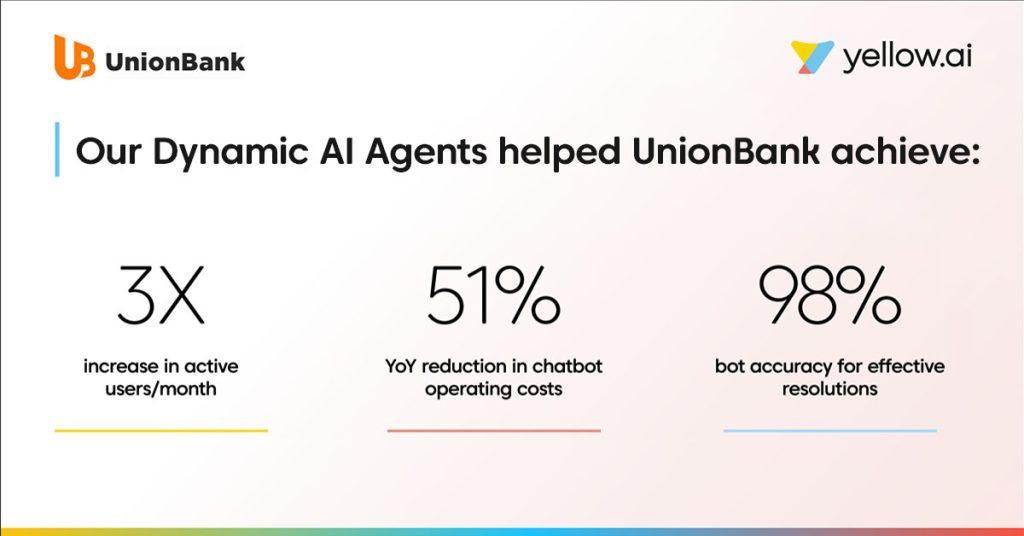

1. UnionBank: A leap in self-serve user experience with AI automation

UnionBank faced the challenge of eliminating prolonged wait times for customer support calls. Their goal was to provide an omnichannel banking experience, empowering customers with self-service options.

UnionBank introduced Rafa, a dynamic AI agent developed by Yellow.ai. Rafa offers on-demand personalized banking services across the bank’s website and Facebook Messenger. The AI chatbot efficiently handles a wide range of queries, including account management and balance inquiries, significantly reducing the need for human intervention.

Impact

- Increased self-serve adoption: The implementation of Rafa led to a threefold increase in monthly chatbot adoption, soaring from 28K to 120K active users.

- Cost efficiency: Operational costs saw a 51% year-on-year reduction thanks to AI-driven automation.

- High bot accuracy: Rafa achieved a remarkable 98% accuracy in providing effective resolutions.

2. Bajaj Finserv: Scaling revenue and customer experience with Yellow.ai

In the competitive financial market of India, Bajaj Finserv needed a standout solution for superior customer experience while maintaining cost efficiency.

Yellow.ai crafted BLU, a multilingual virtual assistant, and deployed it across five channels. BLU addresses customer queries and actively contributes to sales, becoming a pivotal part of Bajaj Finserv’s service strategy. The bot is seamlessly integrated with existing CRM and billing systems, and voice bot services were introduced for enhanced customer service.

Related read: Voice Bot – The complete guide to voice bots

Impact

- Handling volume: BLU has managed over 20 million conversations.

- Cost savings: An impressive $16 million was saved in one year alone.

- Bot efficiency: BLU boasts a high accuracy rate of 95%, ensuring reliable customer interactions.

These stories exemplify how embracing technological innovations like AI-driven chatbots can revolutionize customer service in banking. They illustrate the potential of such technologies to not only improve customer experience but also drive significant operational efficiencies.

How Yellow.ai can help you to improve customer service in banking?

Customer experience is a critical differentiator in the banking sector. Yellow.ai is a pivotal ally in the intricate banking sector, where every interaction counts. Our advanced AI chatbots and dynamic NLP technologies are revolutionizing how banks interact with their customers. Our platform is not just about automation; it’s about creating a symbiosis between technology and the human touch.

Imagine a world where banking queries are not just answered but anticipated, where every customer interaction is tailored to individual needs – this is the reality Yellow.ai brings to the table. With our state-of-the-art AI chatbots, banks can transcend traditional customer service norms, offering solutions that are not only responsive but also insightful and personalized.

Here’s how Yellow.ai stands out:

- Dynamic NLP: Understands and processes customer queries with nuanced precision.

- Robust AI & Machine learning capabilities: Our chatbots aren’t just scripted responders; they learn and adapt, ensuring each interaction is more informed than the last.

- Self-learning bots: Our AI chatbots continuously evolve based on interactions, offering increasingly relevant responses.

- Multilingual support: Our chatbots engage customers in their preferred language, enhancing comfort and understanding.

- Omnichannel integration: Seamlessly integrates across various digital platforms, offering consistent service.

- Seamless integration across channels: Whether it’s mobile apps, websites, or social media, Yellow.ai provides a consistent experience, erasing boundaries between different service platforms.

- Advanced analytics: We offer deep insights into customer behavior, enabling banks to tailor their services precisely.

- 24/7 service availability: With Yellow.ai, banks can offer round-the-clock support, addressing customer needs anytime, anywhere.

- Customization and personalization: Every customer is unique, and our solutions reflect this by offering personalized banking advice and support.

- Compliance and security: We understand the importance of data security in banking, and our solutions are designed to meet the highest standards of compliance and data protection.

By harnessing the power of Yellow.ai, banks can not only meet but exceed the expectations of the modern customer, ensuring satisfaction, loyalty, and a competitive edge in the market.

Book a demo today and experience enhanced customer service in banking with Yellow.ai.

The final thoughts

The banking sector is an ever-evolving landscape where customer expectations and technological advancements are continuously reshaping the dynamics. It is crucial to understand that excellent customer service is vital in the banking sector. More than merely responding to queries, customer service in banking is about creating a banking experience that resonates with customers on a personal level.

The key to unlocking superior customer service in banking lies in the combined efforts of human empathy and technological innovation. The future of banking customer service is bright, dynamic, and customer-centric. Here, every interaction is an opportunity to reinforce the bank’s commitment to its customers. Technology partners like Yellow.ai are invaluable allies in this journey, as they equip banks with the tools to meet and exceed modern customers’ expectations.

Frequently asked questions (FAQs)

How are banks using AI and chatbots to improve service?

Banks are now extensively using AI chatbots to provide immediate, accurate responses to customer inquiries, making banking more accessible and efficient. These AI solutions handle routine questions, leaving complex issues to human agents, thus streamlining the customer service process.

Why is customer service important in banking?

Good customer service in banking fosters trust and loyalty, which are essential for retaining customers in a highly competitive market. It also plays a crucial role in attracting new customers through positive experiences and referrals.

What are the common challenges in banking customer service, and how are they addressed?

Challenges include meeting personalized needs, handling volume during peak times, and integrating digital and traditional services. Solutions involve using AI for routine tasks, training staff in interpersonal skills, and adopting an omnichannel approach.

What role does technology play in modern banking customer service?

Technology, particularly AI and machine learning, plays a significant role in modern banking by enabling personalized experiences, providing 24/7 support, and streamlining processes for efficiency and accuracy.

How is customer feedback incorporated into banking service strategies?

Banks gather feedback through surveys and interaction follow-ups, using this data to understand customer needs, improve service quality, and tailor products and services to meet customer expectations better.

How to handle customer service in a bank?

Effective handling of customer service in banks involves empathetic communication, personalized solutions, efficient problem-solving, and leveraging technology like AI chatbots for consistent, high-quality interactions.