Banking automation has become a must-to-have rather than a good-to-have in the banking sector. Today’s customers seek banks that aren’t just financial institutions but true partners in their financial journey, making their experiences unique and tailor-made for their needs across all channels. But here’s the burning question: are banks living up to these modern expectations?

The World Retail Banking Report threw up some interesting numbers. 52% of customers feel banking is not fun, and 48% consider that their banking relationships are not meshing well with their daily lives. A few customers also mentioned that their banks are missing the mark on providing seamless experiences, the kind of personalization they want, and cutting-edge innovation. This is a wake-up call for banks to step up their game with automation technologies.

Now, think about the banks that are nailing it with banking automation. They’re not just meeting their customer needs but creating strong emotional connections, boosting customer loyalty, and transforming their customers into die-hard fans. Moreover, automation in banking is empowering banks and saving precious time for their employees to focus on strategic tasks instead of getting bogged down by the everyday grind.

And what’s at the forefront of this revolution? Artificial Intelligence (AI) and AI chatbots are the real MVPs driving automation in the banking sector. In this blog, we will take a deep dive into banking automation and explore how it’s evolved into a critical player in the banking sector, streamlining operations, cutting costs, fine-tuning operational precision, boosting customer experiences, and making workforce management a breeze. So, let’s get the ball rolling and dive into the exciting world of banking automation!

Related must-read:

- Customer experience in banking

- Conversational AI in Banking

- Chatbots in banking: Benefits and potential use cases

What is automation in banking?

Automation in banking is the behind-the-scenes superhero for the financial world. It’s about leveraging innovative software and cutting-edge tech to make banking operations smoother and faster. Imagine cutting down on all that manual work – no more endless data entry, account opening marathons, or transaction processing headaches. It gives the green light to efficiency, and accuracy, and saves some serious cash.

Everything runs like a well-oiled machine when banks automate these kinds of tasks. We’re talking fewer errors, more cost-saving, and improved services. It’s a win-win! Banking automation amps up customer satisfaction, making sure that every interaction with their bank is smoother and more reliable.

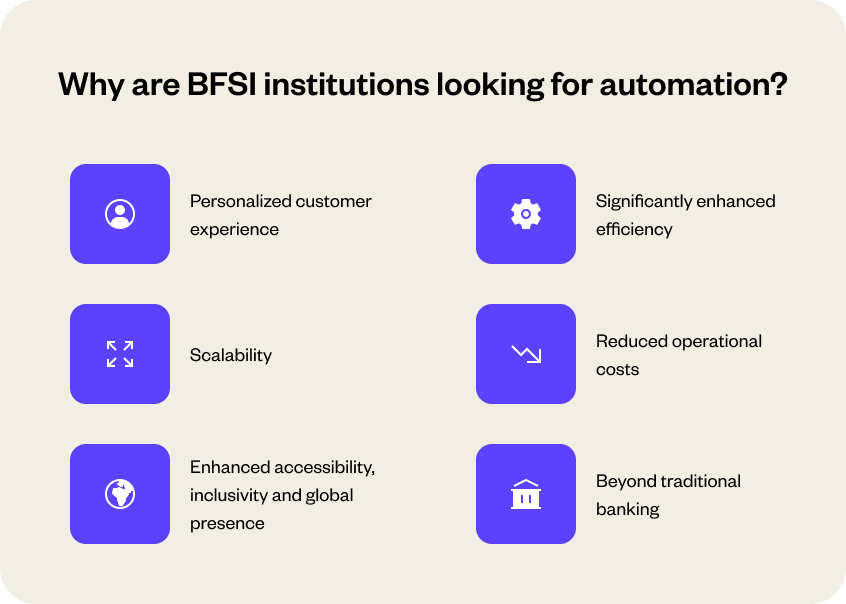

Why are BFSI institutions looking for automation?

In today’s fast-paced financial scene, ever wondered why banks and financial institutions are all focusing on banking automation? Well, It’s not just a trend; it’s a strategic move. With technologies like machine learning (ML), natural language processing (NLP), conversational AI and generative AI, BFSI companies are able to automate intricate tasks, interpret human language, recognize emotions, and adapt to real-time updates.

So, let’s break down why this shift towards automation is happening and how AI-powered automation and chatbots are helping banks navigate complex tasks, get a grip on human language and even recognise emotions.

1. Personalized customer experience:

Today, personalization is the name of the game in the banking sector. It’s the secret sauce that turns casual browsers into dedicated customers and those customers into enthusiastic brand advocates. Enter AI chatbots – the new architects of personalized banking. They’re not just there to answer your queries; they’re there to understand you. These advanced bots meticulously collect feedback, analyze your preferences, and anticipate your needs, constantly evolving to serve your customers better. But it’s not just about convenience. This deep dive into personalization empowers banks to make better and more data-driven, customer-focused decisions.

2. Significantly enhanced efficiency

In today’s fast-paced financial world, ‘high efficiency’ is not just a goal; it’s the standard for success. To that end, technologies like AI chatbots and conversational AI are emerging as game-changers. They not only streamline customer service but also allow human employees to focus on more complex tasks, significantly enhancing overall operational efficiency. AI’s ability to process and analyze vast amounts of data quickly empowers banks to make swift, informed decisions. From improving customer engagement to streamlining internal processes, AI chatbots are pivotal in driving the high-efficiency model that modern banking demands.

3. Scalability

Unlike human resources, scaling up AI chatbot services does not require a proportional increase in costs. Once implemented, AI chatbots in banking offer unparalleled scalability, enabling institutions to efficiently manage fluctuating customer demands with minimal additional investments. Their flexibility allows for easy adaptation to new markets, languages, and regulations, making them ideal for banks’ expansion and global outreach. Furthermore, these chatbots continually evolve through machine learning, improving their efficiency and effectiveness over time, thus aligning perfectly with the dynamic nature of the banking sector.

4. Reduced operational costs

AI chatbots can handle multiple queries simultaneously, far exceeding the capacity of human agents. This efficiency not only improves customer service but also reduces the operational costs associated with managing a large volume of transactions and inquiries. Furthermore, with more customer interactions handled digitally, there’s a reduced need for physical infrastructure like customer service centers or call centers. This reduction in physical infrastructure directly translates into cost savings in terms of real estate, utilities, and maintenance expenses.

5. Enhanced accessibility, inclusivity and global presence

AI chatbots are revolutionizing the banking landscape by demolishing language barriers and making financial services universally accessible. In today’s globalized world, a diverse customer base is the norm, not the exception. AI chatbots rise to this challenge by offering support in a multitude of languages and dialects. This multilingual capability is more than just a feature; it’s a gateway to inclusivity in banking services. What’s truly remarkable is how these chatbots adapt to various linguistic nuances, ensuring that every customer, irrespective of their language proficiency, feels understood and valued.

6. Beyond traditional banking

Modern banks and financial institutions have evolved from being mere transactional hubs to becoming comprehensive financial educators. Leveraging AI chatbots, they now offer a range of services including economic education, financial well-being, and literacy programs. This shift marks a transformation towards understanding and addressing the broader financial needs of customers, providing everything from retirement planning to budgeting advice in one accessible platform.

Use cases: how is automation used in banking sector?

Revolutionizing the banking industry with automation isn’t just about working harder but smarter. Banks are now turning to AI-powered automation and chatbots, not just for routine tasks but to ramp up efficiency with minimal effort significantly. This shift is about optimizing operations and building a rock-solid, smooth-running business.

Many forward-thinking banks have already embraced this trend. They’re harnessing these tech advancements to streamline operations and redefine banking efficiency. It’s a significant shift towards managing banking operations with peak performance and minimal fuss.

Here’s how:

Use cases #1 – Simplified customer onboarding:

Customer onboarding in banking has taken a leap forward with AI-powered automation and chatbots. These technologies effortlessly handle the complex web of regulatory compliance and personal data verification, transforming a cumbersome process into a streamlined and efficient experience. This cuts down the risk, time, and cost of welcoming new customers and sets a new standard in user-friendly banking services, ensuring a smooth and fast onboarding journey.

Use cases #2 – Loans and credits handling:

Handling loans and credits got much smoother with some help from banking automation and AI chatbots. AI chatbots can dive into a centralized data pool to quickly fetch the information needed for loan and credit processing. They’re like digital assistants, making it super easy for the customers and bank teams to make informed, data-driven decisions. These intelligent bots help speed up the process, from approval applications to ensuring cases are wrapped up efficiently.

Use cases #3- Seamless self-serve support

Today Self-serve support in banking doesn’t have to mean endlessly waiting for the right IVR options in the myriad of complicated paths set on them. AI-powered automation is setting a new standard for customer empowerment, providing a seamless and intuitive way to manage their banking needs independently. AI chatbots offer real-time, personalized assistance for various queries, from checking account balances to navigating complex transactions. This shift enhances customer autonomy and convenience and significantly streamlines banking operations, making it more efficient and user-friendly for everyone.

Use cases #4 – Detection of fraudulent activities:

In today’s digital banking landscape, AI chatbots are taking center stage in the fight against fraud. These smart systems are always on alert, analyzing transaction patterns and swiftly identifying anything that seems off. By leveraging their ability to process vast amounts of data quickly, banks are not just detecting potential fraud but are proactively safeguarding the financial integrity of banks and the security of customer transactions.

Use cases #5 – Improve customer services

AI chatbots and banking automation are revolutionizing customer service. Banks and financial institutions are harnessing these technologies to provide instant, accurate responses to a multitude of customer queries day and night. These AI-driven chatbots act as personal bankers at customers’ fingertips, ready to handle everything seamlessly, from account inquiries to financial advice. They’re transforming banking into a more responsive, customer-centric service, where every interaction is tailored to individual needs, making the banking experience more intuitive, convenient, and human.

Related read: How to improve customer service?

Use cases #6 – Improve employee experience

AI chatbots have stepped up the game of employee experience by leaps and bounds. These smart systems take the reins on repetitive, manual tasks, ensuring accuracy and freeing bank staff to focus on more complex, strategic work. This shift increases job satisfaction as employees engage in meaningful tasks and grow their skill sets. Moreover, it’s a cost-effective strategy, reducing processing expenses significantly. Ultimately, AI-driven automation is creating a more dynamic, efficient, and satisfying work environment in banking.

Related read: How to build an effective employee experience strategy?

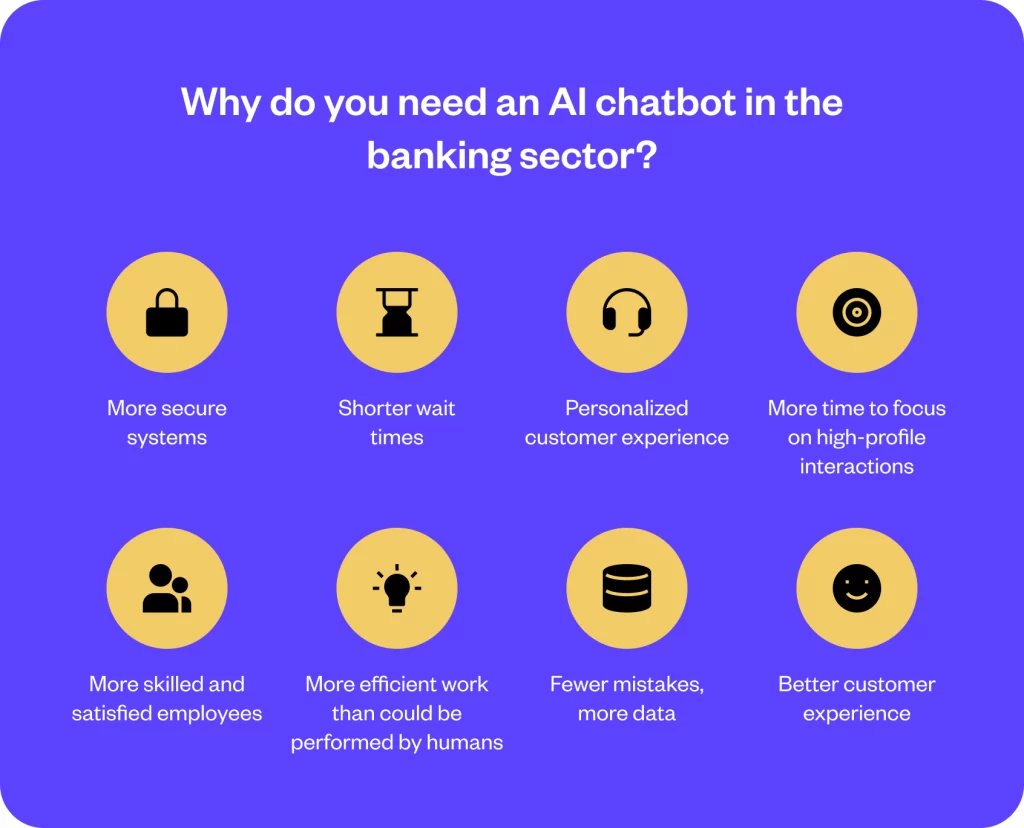

Why do you need an AI chatbot in the banking sector?

Well, the world has evolved in a way that a trip to the bank for a quick query is not something any customer is ready to take on today! Customers want solutions at their fingertips, and with minimal wait time. This is where AI-powered chatbots shine as the ideal solution. They have become the digital version of customer support and emerged as a new way to interact, offering personalized, prompt and efficient assistance on the text and voice-based channels of their choice.

So, let’s dive into the AI chatbots and learn why these chatbots are the best automation tools in banking.

1. More secure systems:

AI chatbots, as a vital part of banking automation, enhance security in banking by employing advanced algorithms to monitor and analyze transactions for potential fraud. They can recognize suspicious patterns faster than humans, adding an extra layer of security to protect sensitive customer data and financial transactions.

2. Shorter wait times:

In the realm of automation in banking, AI chatbots provide immediate responses to customer inquiries, significantly reducing wait times. Unlike human agents, chatbots can interact with multiple customers simultaneously, ensuring quick and efficient service.

3. Personalized customer experience:

Through data analysis and machine learning, AI chatbots offer personalized banking experiences. They remember customer preferences, suggest relevant products, and provide tailored advice, making each interaction unique and meaningful.

Related read: Conversational AI for Customer Experience?

4. More time to focus on high-profile interactions:

AI chatbots free up human employees to focus on more complex and high-value interactions by automating routine tasks and inquiries. This shift allows bank staff to concentrate on strategic activities and deepen customer relationships.

5. More skilled and satisfied employees:

With AI doing the heavy-lifting for support and overall CX, human employees are freed up to build stronger relationships with the customers and build products and solutions that help the business scale new heights. This enhances skill development and job satisfaction, contributing more significantly to the bank’s success.

6. More efficient work than could be performed by humans:

AI chatbots work with unparalleled speed and efficiency, handling tasks like data entry, transaction processing, and customer queries much faster than humans, increasing overall operational efficiency in the bank. Not just this, today’s advanced chatbots can handle numerous conversations simultaneously, and in most global languages and dialects.

7. Fewer mistakes, more data:

Minimizing human error in data handling and customer service, AI chatbots process and analyze large volumes of data with high accuracy, providing insights for decision-making and service improvement, and all of this at unprecedented speed.

8. Better customer experience:

The combination of personalized service, quick responses, and efficient problem-solving by AI chatbots leads to a superior customer experience, ensuring consistent, high-quality service in every interaction.

Yellow.ai case study for banking automation

UnionBank achieves 3X increase in self-serve users with AI automation

Challenge:

With a vision of ‘Leading the Future of Banking’, UnionBank wanted to leverage technology to provide an omni-channel banking experience for its customers. They were looking to elevate customer experiences by eliminating long wait times to reach customer support over calls by deploying an AI chatbot on two channels (Website and Facebook Messenger). Thus, enabling customer self-serve options to instantly resolve customer queries with conversational AI.

Solution:

Dynamic AI agent – Rafa which was designed to offer on-demand personalized banking services and enhanced self-serve adoption to UnionBank customers.

Impact:

- High CSAT – 3x increase in chatbot usage from 28K to 120K active users per month

- Reduced costs – YoY reduction in chatbot operating costs

- High accuracy – 98% bot accuracy for effective resolutions at scale

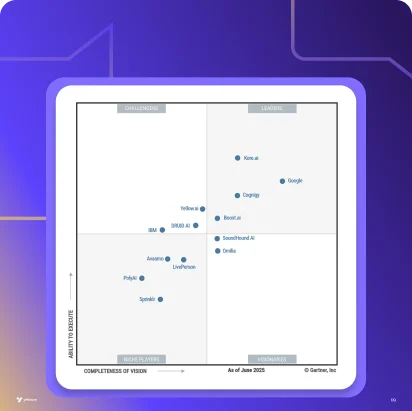

How can Yellow.ai help with banking automation?

With the market full of AI-enabled platforms, what makes Yellow.ai stand out from the crowd? And how it will be a best-in-class solution, especially for banking automation? Here’s why

1. 24/7 customer interaction: Yellow.ai’s Dynamic Automation Platform ensures that banks can interact with their customers around the clock. This constant availability transforms customer service, enabling instant responses to queries and offering an unparalleled level of convenience.

2. Hyper-personalized banking experiences: By leveraging advanced AI algorithms, Yellow.ai crafts highly personalized banking experiences. Customers receive tailor-made advice and product recommendations, significantly boosting satisfaction and loyalty.

3. Efficient transaction processing: Yellow.ai automates routine transactions like balance checks, fund transfers, and bill payments, significantly reducing processing time and enhancing operational efficiency.

4. AI-powered insights: With its robust analytics, Yellow.ai provides banks with deep insights into customer behavior and preferences. These insights can drive strategic decisions, helping banks to better align their services with customer needs.

5. Seamless integration: Yellow.ai’s platform seamlessly integrates with existing banking systems and databases. This integration ensures a smooth transition to automated processes, without disrupting ongoing operations.

6. Omnichannel support: Whether it’s through social media, email, or mobile apps, Yellow.ai ensures consistent and effective communication across all channels. This omnichannel approach allows banks to engage with customers on their preferred platforms.

7. Compliance and regulatory adherence: In a heavily regulated industry like banking, compliance is key. Yellow.ai’s solutions are designed to adhere to regulatory standards, ensuring that all automated processes are compliant with the latest regulations.

8. Empowering human agents: Beyond customer-facing roles, Yellow.ai also enhances the productivity of bank employees. By automating routine tasks, it allows human agents to focus on building better relationships with customers.

Conclusion

As we journey through the evolving landscape of the BFSI sector, it’s evident that AI-driven banking automation is no longer a futuristic concept but a present-day necessity. This evolution is not just about efficiency and cost savings; it’s about redefining the banking experience for customers and employees alike.

Banking automation, spearheaded by AI and AI chatbots, has emerged as a game-changer in personalizing customer interactions, optimizing operational efficiency, and fostering a more inclusive and global banking environment. From simplifying customer onboarding to enhancing fraud detection and improving employee experiences, the impact of these technologies is profound and multifaceted.

For those looking to navigate this dynamic landscape successfully, the role of a reliable, innovative technology partner becomes crucial. A partner like Yellow.ai stands at the forefront of this revolution, offering cutting-edge solutions that ensure 24/7 customer interaction, hyper-personalized experiences, efficient transaction processing, and compliance with regulatory standards.

In essence, banking automation and AI are not just about keeping up with the times; they are about setting new standards, driving growth, and building more robust, more resilient financial institutions for the future. Embrace these technologies with Yellow.ai and embark on a journey toward a more efficient, customer-centric, and innovative banking future.

Elevate banking efficiency with AI automation