6 Examples of conversational AI in banking and why they are important for success

Amid the unprecedented digital progression, the banking industry is witnessing a paradigm shift towards conversational AI banking. Adopting conversational AI for banking is no longer an optional choice but a strategic imperative. This article delves deep into the significance, implementation, and future outlook of conversational AI in banking. With the landscape redefining due to AI banking solutions and industries keenly exploring AI solutions for banks, the future promises customers a seamless and enhanced banking experience.

A seismic digital transformation is rippling through the banking and financial industry, nudging it to break away from the traditional banking model. Remember the days when updating a passbook meant waiting in long, tedious queues? Thanks to breakthroughs in conversational AI, those days are drawing to a close. These AI-driven solutions, already making waves, aren’t mere futuristic speculations but tangible game-changers reshaping customer experiences.

The Banking, Financial Services & Insurance (BFSI) sector has traditionally been an early adopter of technology. Today, it finds itself at the crossroads of tradition and innovation, with conversational AI being the compass guiding the way. Digital Banking Report’s research underscores this evolution, highlighting that 75% of financial institutions are inclined to harness conversational AI, data, and analytics to elevate their services. If we’re taking cues from this trajectory, the message is clear: Conversational AI in banking is not just the future; it’s the present.

Introduction of conversational AI in banking

Conversational AI has emerged as a cornerstone in modern banking, bridging the divide between the human touch and technological efficiency. At its core, conversational AI is a sophisticated blend of artificial intelligence designed to mimic human conversations. Unlike its primitive predecessors, today’s conversational AI for banking is no mere script-following entity. Instead, it harnesses advanced natural language processing (NLP) and machine learning techniques, enabling it to comprehend, respond, and even predict customer inquiries accurately.

Related read: Conversational AI – A complete guide for [2023]

Banks worldwide are swiftly recognizing the transformative power of conversational AI. According to industry insights, most banking executives believe this AI-driven communication will soon dominate customer interactions. The rationale? An ever-evolving customer base craves personalized, instantaneous services, and conversational AI caters precisely to this demand. Amplified by recent global shifts like the COVID-19 pandemic, which propelled the masses towards digital banking platforms, the integration of conversational AI is necessary to ensure that banks remain agile, responsive, and relevant in this digital epoch.

Why is conversational AI important in banking?

Conversational AI isn’t just a technological embellishment; it’s a pivotal instrument shaping the modern banking landscape. Delving into its importance, we find:

1. Multichannel engagement

- Integrated experience: Conversational AI provides a unified banking journey across platforms, from mobile apps to messaging platforms like WhatsApp.

- Centralized communication: AI centralizes interactions from different channels, ensuring seamless and consistent responses to every customer query.

2. Enhanced accessibility and service

- 24×7 availability: Modern banking is round-the-clock, and conversational AI ensures that customer inquiries are addressed anytime, anywhere.

- Proactive engagement: Modern chatbots predict and solve issues, amplifying customer satisfaction and strengthening loyalty.

3. Boosted operational efficiency

- Cost efficiency: Automating routine inquiries via AI can carve out significant operational savings.

- Precision and scalability: Chatbots ensure accuracy in responses and can handle surges in interactions without additional costs.

4. Empowering human agents

- Focused attention: With chatbots managing standard queries, human agents can address unique, complex issues, enhancing efficiency.

- Effective transitions: When chatbots gather initial information, agents can resolve issues faster without redundant questions.

5. Leveraging data insights

- Informed decisions: Conversational AI accumulates valuable customer data. Banks can harness this to refine strategies and understand customer preferences.

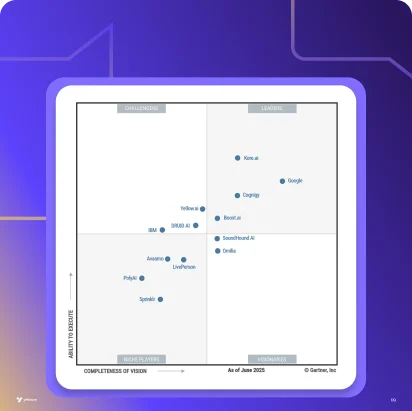

Must read: 10 Top conversational AI platforms in 2024

How conversational AI is used in banking?

Efficiency, speed, and reliability are non-negotiables in the banking world, and conversational AI emerges as a vital ally. At its essence, conversational AI automates and refines repetitive processes, offering solutions that surpass in speed and accuracy compared to traditional methods. This shift isn’t merely about operational efficiency; it’s also a testament to enhancing credibility—a currency of immense value in the banking sector.

When studies like the one by Accenture project a staggering $1 billion boost in the financial services industry value by 2035, thanks to AI solutions, it’s evident that we’re entering a new epoch of banking operations and customer service.

But what does this look like in tangible terms for banks today? From enhancing personalized customer experiences to processing vast amounts of data at breakneck speeds, conversational AI takes center stage. For instance, it assists in fraud detection by analyzing transaction patterns, offers instant loan approvals based on real-time credit assessments, and ensures 24×7 customer service, addressing queries ranging from account balances to financial planning. This ever-growing list of AI-driven banking use cases is a testament to conversational AI’s transformative and pivotal role in modern banking, elevating operational efficiency and customer satisfaction.

Examples of conversational AI in banking

Today’s banking climate aims to integrate advanced technology with human-centric services seamlessly. This integration caters to clients’ evolving demands, ensuring accessibility, speed, and personalization in every interaction.

Conversational AI stands out as a powerful tool, ushering in a new era of customer service and operational efficiency. Let’s explore some tangible applications of conversational AI in the banking industry, highlighting their significance and how platforms like Yellow.ai amplify these experiences.

1. FAQ bot: Staying informed, instantly

Many customer inquiries often revolve around common questions, whether understanding account features or clarifying banking policies. The FAQ Bot is the front line in addressing these queries.

Unlike conventional methods that involve navigating cluttered websites or enduring long wait times on calls, the FAQ Bot offers real-time, concise answers. Accessible 24/7, it ensures that clients can instantly access information without sifting through layers of content. As a bonus, Yellow.ai ensures that the FAQ bot remains updated, drawing from a vast database and providing accurate and relevant answers.

2. Q-Jump bot: No more waiting, only action

We’ve all been there – endless minutes ticking by as we hold for a representative. The Q-Jump Bot revolutionizes this experience. Instead of placing customers in long queues, this bot instantly interacts, capturing essential details or even addressing the query if possible.

If the issue needs human intervention, the bot schedules a callback, ensuring customers aren’t left hanging. This immediate responsiveness, augmented by platforms like Yellow.ai, makes banking interactions smoother and more client-centric.

3. Account bot: Your financial snapshot, on-demand

Customers prefer immediate insights into their financial status. The Account Bot serves this need. With a simple prompt, clients can access account balances, recent transactions, payment deadlines, and more details. It’s not just about passive information retrieval; this bot, bolstered by Yellow.ai’s robust security measures, can even facilitate specific account-related tasks, offering a comprehensive banking experience round the clock.

4. Payment bot: Simplifying transactions

As digital transactions surge, the demand for swift, hassle-free payment processes becomes paramount. The Payment Bot streamlines this experience. It can notify customers about upcoming due dates, verify transactions, and process payments – all within a secure environment. Yellow.ai enhances this bot’s capabilities, ensuring smooth authentication and quick access, making digital transactions almost effortless.

5. Chargeback bot: Transparency and resolution, simplified

Discrepancies in statements can be daunting for customers. The Chargeback Bot provides clarity. It offers instant information about specific charges and initiates the chargeback process in cases of discrepancies. With the multi-channel capability of platforms like Yellow.ai, transitioning from one communication mode to another becomes seamless, whether from an email to a voice-activated device or an SMS.

6. Onboarding bot: The first step, made effortless

Onboarding is a critical phase in a customer’s banking journey. The Onboarding Bot ensures this experience is smooth, quick, and efficient. This bot handles everything from capturing initial details and guiding customers through document submissions to obtaining digital signatures. Additionally, it can answer related queries and update clients about their application status. With platforms like Yellow.ai, this onboarding process is further refined, ensuring customers feel welcomed, informed, and valued from the very beginning.

Future of conversational AI in banking

The evolution of conversational AI in the banking sector promises transformative shifts fueled not just by present applications but by the horizon of emerging innovations. With the integration of banking chatbots and voice assistants becoming increasingly ubiquitous, banks are set to offer an even more refined, personalized, and streamlined customer experience. As we stand at the precipice of this change, two main developments emerge: the deepening of current conversational AI capabilities and the integration of generative AI.

Generative AI, which melds deep learning with sophisticated natural language processing, is heralding a new epoch in customer-banker interaction. Unlike its conversational counterpart, generative AI crafts hyper-personalized and dynamic interactions, tailoring responses with precision and flair.

Envision a scenario where AI discerns a client’s financial tendencies, such as a penchant for travel or gourmet experiences, and proactively suggests a curated credit card package, resonating with those specific inclinations. Such advancements encapsulate the future: a blend of keen insight, proactive engagement, and a banking experience that feels intuitive and revolutionary.

Conclusion: The pinnacle of personalized banking

The banking industry’s seismic transformation, driven by the integration of conversational AI, has undeniably reshaped the fabric of customer interactions and operational efficiency. The blend of human touch with AI precision, as illustrated by platforms like Yellow.ai, presents an advanced model of banking that’s agile, responsive, and supremely tailored to the modern user’s demands.

Conversational AI empowers banks to converse, understand, and evolve with their customers

Conversational AI in Banking – FAQs

What is an example of a conversational AI bank?

An example of a conversational AI bank would be integrating chatbots and voice assistants, like the FAQ Bot or Payment Bot. These AI-driven tools facilitate real-time interactions, answer customer queries instantly, and streamline various banking processes.

How can conversational AI benefit the finance industry?

Conversational AI offers many benefits to the finance industry, including 24×7 customer service availability, automation of routine tasks leading to cost savings, precise and scalable interactions, and gathering valuable data insights to refine strategies and tailor services to customer preferences.

How is AI used in banking and finance?

AI in banking and finance is used in various ways. It includes fraud detection through transaction pattern analysis, instant loan approvals based on real-time credit assessments, 24×7 customer service using chatbots, and processing vast amounts of data quickly and accurately. Moreover, platforms like Yellow.ai further refine these processes, ensuring optimal efficiency and customer satisfaction.

What are the uses of AI in banking and finance?

AI plays a pivotal role in modern banking, aiding in tasks such as personalizing customer experiences, detecting fraud, automating repetitive tasks, providing real-time credit assessments, and ensuring round-the-clock customer service. Additionally, it helps understand customer behavior and preferences and creates tailored banking solutions.

What is the future of AI in banking?

The future of AI in banking promises a deeper integration of tools like chatbots and voice assistants. Furthermore, with the emergence of generative AI, banking interactions will become even more personalized, dynamic, and intuitive. Customers can expect more proactive engagements, where AI tools discern financial tendencies and make hyper-personalized recommendations, leading to a revolutionary banking experience.

What are the disadvantages of AI in the banking industry?

While AI offers transformative benefits, it has challenges. Potential disadvantages include concerns over data privacy, the risk of over-reliance leading to potential vulnerabilities, potential job displacements due to automation, and the intricacies of managing and updating AI systems. Moreover, AI tools might misinterpret customer requests without proper implementation, leading to unsatisfactory experiences.