When people think of insurance, they often picture cumbersome paperwork, drawn-out claims processes, slow responses, and an industry somewhat stuck in its ways.It’s an industry stereotypically pegged for its conservative approach and resistance to change. However, data available on the matter paints a different picture. According to recent reports, the global insurance chatbot industry which generated a whopping $467.4 million just last year, is even more impressively projected to balloon to $4.5 billion by 2032!

This means that insurance companies are not only turning traditional paradigms upside down, they are also redefining the entire customer journey and fast! Chatbots and voicebots, equipped with cutting edge AI technology, are helping them simplify mundane processes; minimize operational costs, and bid adieu to the old-world inefficiencies that were holding them back!

Let’s take a deeper look into how insurance automation actually works, and how leading insurance players globally are leveraging conversational AI to stay ahead of the curve.

What is insurance automation?

Think about insurance for a moment. Traditionally, it’s been a maze of paperwork, phone calls, and waiting times, right? Well, automation is like giving the insurance industry a much-needed tech makeover. Strip away the jargon, and automation is all about using technology to simplify those hefty, time-consuming processes that have long defined the insurance world.

Automation holds a special significance for the insurance industry. Here’s why: Insurance has long been bogged down by manual, paper-driven tasks. These tasks not only consumed time but also introduced human errors. Now, imagine instead of wading through forms, your customers get to interact with a friendly chatbot that processes their information in seconds. Or rather than wait days for a claim approval, AI-powered algorithms assess risks and fast-track decisions. For businesses, this translates to reduced costs, better productivity and improved customer loyalty. For customers, it’s a breath of fresh air – efficient services, quicker responses, and a whole lot less headache.

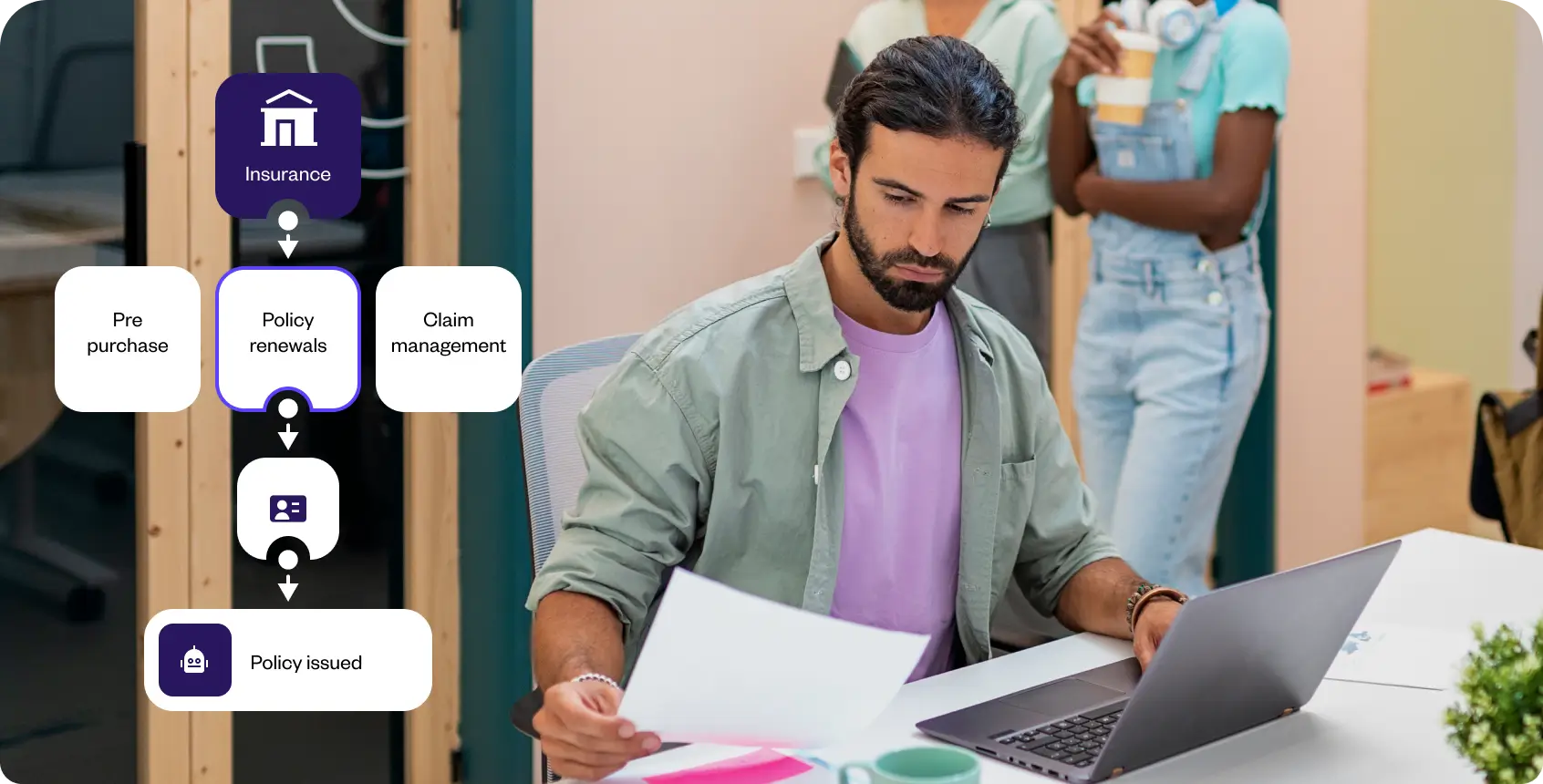

How does automation work for insurance businesses?

Diving into the mechanics, automation for insurance isn’t just about streamlining backend processes; it’s about creating a holistic experience for both customers and businesses. Central to this transformation is the magic of Conversational AI.

1. First touchpoint:

Typically, the journey begins when a potential customer interacts with a chatbot on an insurance website or app. Powered by conversational AI, the chatbot can instantly provide insurance quotes, answer FAQs, and even guide the user through policy selection, making the initial interaction smooth and informative.

2. The claim game:

One of the traditionally painstaking aspects of insurance has been claims processing. Conversational AI can assess the validity of claims in real-time. When a customer inputs their claim details, AI algorithms analyze the data against the policy’s terms, fast-tracking genuine claims and flagging potentially fraudulent ones for further review.

3. Personalized policy recommendations:

By analyzing a customer’s data and past interactions, AI-driven automation can offer tailored insurance recommendations. Instead of one-size-fits-all policies, customers receive suggestions aligned with their specific needs and preferences.

4. Real-time risk assessment:

Using data analytics, AI can instantly evaluate a customer’s risk profile. This enables faster policy underwriting and helps insurance providers set more accurate premium rates.

5. Ongoing customer support:

Beyond just initial interactions, conversational AI provides round-the-clock support, if needed in the customer’s preferred language and channels. Whether a customer has a query about their policy, needs assistance with renewals, or wants to understand claim status, AI chatbots are there to assist 24/7, ensuring that no query goes unanswered.

In essence, conversational AI-driven automation streamlines the insurance process at every stage, from the initial query to the claim settlement. For insurance businesses, this means higher efficiency, reduced operational costs, and enhanced customer satisfaction. It’s like having a super-efficient, always available team member who’s perpetually ready to assist. And in the competitive world of insurance, this edge can make all the difference.

What are some examples of automation in the insurance industry?

Conversational AI has fast become the bridge to precision, user-centric experiences, and streamlined efficiency, and most importantly, a source of amplified revenue. Here are some examples of how automation is working wonders in the insurance industry:

- Claims processing

- Policy underwriting

- Customer onboarding

- Document management

- Regulatory compliance

- Fraud detection

- Customer service and support

1. Claims processing

Traditionally, processing claims used to be a cumbersome task laden with paperwork and long waiting periods. Today, conversational AI steps in, enabling customers to submit claims through simple chat interfaces. These AI-driven systems can instantaneously review the data, cross-check with policy details, and even approve straightforward claims. This not only accelerates the process but also significantly reduces human error.

2. Policy underwriting

Underwriting has always been at the core of insurance – determining risks and setting premiums. With automation, data-driven insights are leveraged to analyze a client’s risk profile. AI models can sift through vast amounts of data, from medical records to driving history, to make accurate risk assessments, ensuring policies are both competitive and fair.

3. Customer onboarding

First impressions count. Instead of lengthy forms and multiple visits or calls, now, AI chatbots can guide new customers through the onboarding process. These chatbots can answer questions in real-time, gather necessary information, and even suggest the best policies tailored to individual needs. It’s all about making the initial experience smooth and personalized.

4. Document management

In the digital age, managing countless documents efficiently is paramount. Automation tools categorize, store, and retrieve documents in seconds. They can also trigger reminders for policy renewals or required updates, ensuring nothing slips through the cracks.

5. Regulatory compliance

Navigating the maze of regulations in insurance can be daunting. Automated systems are updated with the latest regulatory requirements. They ensure that all processes, right from policy creation to claim settlement, are in compliance with the prevailing laws, minimizing the risk of violations.

6. Fraud detection

Insurance fraud is a multi-billion-dollar problem. AI models are trained to detect anomalies or suspicious patterns in claim submissions. By analyzing previous fraud cases and recognizing red flags, these systems can alert investigators to potential fraud, saving the industry and honest policyholders money.

7. Customer service and support

Immediate and accurate response is the name of the game. Chatbots, powered by advanced AI, are available round-the-clock to answer customer queries, provide policy details, or assist in claims. These bots can handle a myriad of questions simultaneously, ensuring no customer is left waiting.

Business benefits of insurance automation powered by conversational AI

By marrying traditional insurance processes with the agility of AI, businesses are unlocking unparalleled efficiencies and customer experiences. Here are some of the top business benefits of insurance automation:

- Personalized policy recommendations

- 24/7 availability

- Cost savings

- Instantaneous response times

- Enhanced customer reach

- Continuous learning

- Risk assessment with precision

- Streamlined policy management

- Swift claim settlements

- Enhanced customer trust

- Competitive edge

Personalized policy recommendations: Harness AI’s power to recommend policies tailored specifically to individual needs, ensuring precision and personalization in every suggestion.

24/7 availability: Customers operate round-the-clock, and so should your service. With AI, ensure non-stop availability, meeting needs at any hour.

Cost savings: By automating processes and minimizing manual interventions, businesses can significantly reduce overheads. The outcome? Improved margins and efficient operations.

Instantaneous response times: Immediate answers to policy inquiries and claim statuses? Achievable with AI. No delays, just instant, accurate information.

Enhanced customer reach: Venture effortlessly across borders. Cater to diverse audiences, spanning varied time zones, languages, and cultural nuances.

Continuous learning: Every interaction is an opportunity for growth. With each chat, the bot refines its approach, ensuring it’s consistently evolving and improving.

Risk assessment with precision: Dive deep into multifaceted factors — from market dynamics to geopolitical issues — to offer businesses accurate, timely risk assessments.

Streamlined policy management: Navigate the complexity of multiple policies with ease. Review, renew, or update policies without sifting through paperwork, missing deadlines, or facing confusion.

Swift claim settlements: In challenging times, businesses need prompt solutions. Ensure rapid claim assessments and timely payouts, mitigating disruptions effectively.

Enhanced customer trust: For insurance businesses, customer trust is pivotal. Offering streamlined, transparent, and efficient processes not only ensures customer satisfaction but also fosters trust and brand loyalty.

Competitive edge: Position your business at the forefront of the industry. Leveraging intelligent automation not only enhances operational efficiency but also signals a modern, tech-forward approach to stakeholders.

How Yellow.ai can help you get ahead with insurance automation?

At the heart of Yellow.ai’s transformative approach to the insurance sector is our generative AI-powered Dynamic Automation Platform (DAP). Designed to redefine customer interactions, this platform combines the prowess of generative AI with intricate process automations, ensuring each conversation is not just responsive but proactive, insightful, and tailored to individual needs.

Embracing global diversity with multi-lingual support

Our world is a melting pot of languages and cultures. Yellow.ai’s bots are equipped to understand and interact in over 135+ global languages and dialects for incredibly human-like conversations whether it’s through text or voice-based bots!

Unified experience with omnichannel presence

Your customers are everywhere – from WhatsApp and web chat to voice assistants. Yellow.ai guarantees consistent and seamless interactions across all these platforms, giving users a cohesive experience no matter where they engage.

Tailored conversations for personal touch

Every individual’s insurance needs and questions are unique. Yellow.ai bots, leveraging real-time insights, offer personalized interactions that provide contextual and relevant responses, making every user feel valued.

Deep dive with advanced analytics

Knowledge is power. With Yellow.ai, you can access detailed metrics – from chat analytics to sentiment analysis – ensuring you have a comprehensive understanding of your customers’ preferences and pain points.

Seamless system integrations

With Yellow.ai you wouldn’t need to add on to your current tech stack. Yellow.ai’s platform is designed to seamlessly integrate with 100+ systems out of the box, whether they are CRM, ERP, and other systems, offering an integrated and smooth experience for both your team and customers.

Conclusion

In just the span of a decade, the insurance chatbot industry has surged from being a niche tech novelty to a multi-billion-dollar behemoth. In 2022 alone, this sector raked in an impressive $467.4 million, and is expected to grow at a CAGR of 25.6% from 2023 to 2032. What’s driving this meteoric rise? The transformative power of automation and conversational AI.

As industries globally embrace change, the insurance sector stands out for its proactive adoption of AI-driven solutions. Rather than merely riding the digital wave, it’s harnessing its force. Yellow.ai’s Dynamic Automation Platform enhances the human element in every interaction, making every policyholder feel recognized and valued.

Through the blend of AI and a human touch, the insurance sector is not just set to meet customer expectations but surpass them, crafting a new era defined by innovation, trust, and excellence. And in this, Yellow.ai stands out as a partner that not only understands the industry’s intricacies but also is dedicated to ensuring excellence in every digital interaction.