Executive summary

Long-term customer relationships are crucial for every business today. Hence, understanding and optimizing Customer Lifetime Value (CLV) has never been more important. This blog explains Customer Lifetime Value (CLV) and its transformative power in driving business growth. Learn about the crucial formula components like Average Order Value and Purchase Frequency, and explore ten effective strategies to boost CLV. Whether you’re a seasoned marketer or a budding entrepreneur, this guide offers valuable insights to enhance your understanding of CLV and its impact on your business’s long-term success.

Introduction

Understanding Customer Lifetime Value (CLV) in today’s competitive market is like learning the steps to a dance that can lead your business to success. It’s about knowing your customers not just as numbers in a spreadsheet but as partners in a journey that could span years or even decades. Customer Lifetime Value helps businesses harmonize their efforts with customer needs, creating a rhythm that resonates with loyalty and sustained growth.

Today, every customer interaction weaves the tapestry of brand loyalty, and CLV can be a guiding force for creating strategies toward long-term success. As we peel back the layers of CLV, we find more than just data and dollars – we discover a narrative of relationships, experiences, and the potential for mutual growth. This blog is a voyage into understanding how every interaction with your customers can be a stepping stone toward a more prosperous future. Join us as we decode the essentials of CLV, transforming the way you view customer interactions and their long-term value to your business.

Related must-reads:

- Customer service strategy: A step-by-step guide

- 12 Customer service metrics to measure in 2024

- 10 Reasons why is customer service important in 2024

- How can customer journey maps improve customer experiences?

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is an essential metric at the crossroads of marketing, sales, and customer service. It’s an insightful measure that reflects the total worth of a customer to a business over their entire relationship. Understanding CLV is more than assessing past transactions; it’s about predicting future value and shaping strategic decisions to foster long-term relationships.

Segmenting Customer Lifetime Value (CLV)

CLV encapsulates two critical dimensions:

- Total average revenue: This dimension quantifies the cumulative revenue a customer generates for your business. It goes beyond a single transaction, encompassing every purchase, renewal, and upsell throughout the customer’s journey with your business.

- Total average profit: Moving deeper than revenue, this aspect considers the net profit each customer contributes. It factors in the costs associated with goods sold, shipping, fulfillment, and other operational expenses, offering a true reflection of the customer’s profitability to the business.

For businesses seeking detailed insights into their customer base, segmenting CLV can be exceptionally revealing. Analyzing CLV by different customer segments or quartiles uncovers patterns and preferences among your high-value customers, offering strategic pointers on where to focus your efforts for maximum impact.

CLV is not just a number – it’s a strategic tool. It guides businesses in tailoring marketing efforts, refining customer service approaches, and optimizing product offerings to align with the long-term value of customers. Focusing on CLV encourages businesses to invest in nurturing transactions and enduring customer relationships. Hence, it leads to a loyal customer base that increases in value over time.

While CLV can be calculated through complex models that include marketing expenses and varied operational costs for practicality and clarity, this discussion focuses on its fundamental components. This approach makes CLV a tangible and actionable metric for businesses aiming to enhance their understanding of customer value and drive sustainable growth.

What is the difference between CLV and LTV?

Regarding customer relationship metrics, two terms often surface: Customer Lifetime Value (CLV) and Lifetime Value (LTV). While these terms are frequently used interchangeably in the industry, understanding their nuanced differences can offer more clarity and precision in your business strategies.

CLV vs. LTV: A subtle distinction

Customer Lifetime Value (CLV): This term is typically used to signify the value of an individual customer to your business over the entire duration of their relationship with you. CLV is more personalized, focusing on the specific journey and spending pattern of each customer. It reflects a micro-level understanding of customer interactions and their impact on your revenue.

Lifetime Value (LTV): LTV, on the other hand, is often employed to describe a broader perspective – the average value of all your customers over their lifetimes with your brand. It’s a macro-level metric that aggregates data across all customers to provide an average value. This broader view is crucial for high-level strategic decisions and understanding overall market trends.

Why the difference matters

The distinction between CLV and LTV, albeit subtle, can have significant implications for your business strategies:

- Targeted marketing: Understanding CLV enables you to tailor your marketing efforts to individual customer profiles, creating more personalized experiences that can increase customer loyalty and spending.

- Resource allocation: Knowing your LTV helps in making informed decisions about resource allocation, marketing budgets, and customer acquisition strategies.

- Product development: CLV can guide you in developing or tweaking products and services to meet the specific needs of different customer segments.

- Market forecasting: LTV assists in forecasting market trends and understanding the overall health and potential of your customer base.

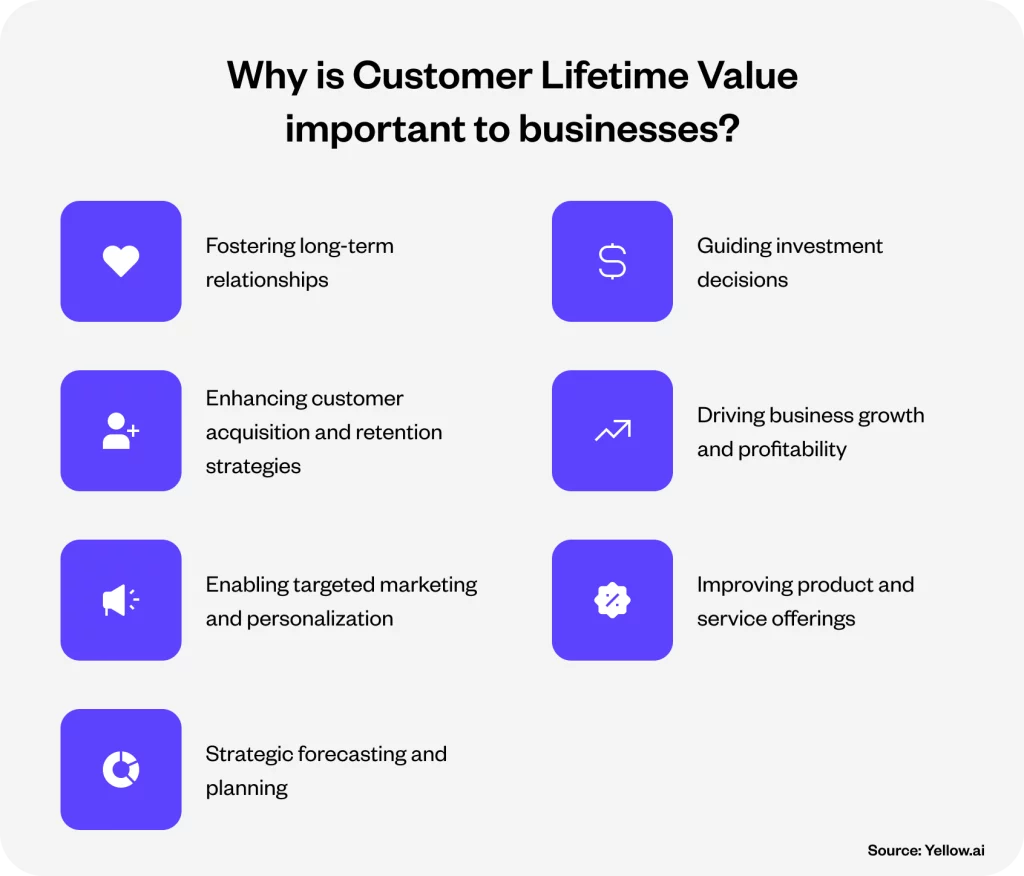

Why is Customer Lifetime Value (CLV) important to businesses?

Customer Lifetime Value (CLV) is a metric that shapes the way companies interact with their customers and strategize for the future. The importance of CLV to businesses lies in its ability to transform customer relationships into tangible assets, influencing everything from marketing strategies to product development.

1. Fostering long-term relationships

CLV shifts the focus from short-term transactions to long-term relationships. Businesses start to see customers as partners in a continuous journey rather than one-time buyers. This perspective encourages strategies that prioritize customer satisfaction and loyalty, ultimately leading to more stable revenue streams.

2. Guiding investment decisions

Knowing the CLV helps businesses make more informed decisions about how much to invest in acquiring and retaining customers. It provides a clearer picture of what a customer is worth in the long run, allowing for smarter allocation of resources and budget.

3. Enhancing customer acquisition and retention strategies

Understanding CLV empowers businesses to tailor their customer acquisition efforts toward attracting high-value customers. Similarly, retention strategies can be fine-tuned to focus on keeping these valuable customers engaged and satisfied, reducing churn and increasing profitability.

4. Driving business growth and profitability

A deep understanding of CLV can lead to significant growth and profitability. By identifying the factors that enhance customer value, businesses can optimize their operations, offerings, and customer interactions to drive up the lifetime value of each customer.

5. Enabling targeted marketing and personalization

With insights from CLV analysis, businesses can create more targeted marketing campaigns that resonate with specific customer segments. Personalization becomes more strategic, leading to higher engagement and conversion rates.

6. Improving product and service offerings

CLV data can inform product development and service improvements. By understanding what high-value customers appreciate and need, companies can innovate in ways that meet and exceed these expectations, further boosting customer loyalty and CLV.

7. Strategic forecasting and planning

CLV is a powerful tool for forecasting and planning. It helps businesses anticipate future revenue streams and plan accordingly, ensuring they are well-equipped to meet customer demands and market changes.

What is the formula for calculating Customer Lifetime Value? [+ Examples]

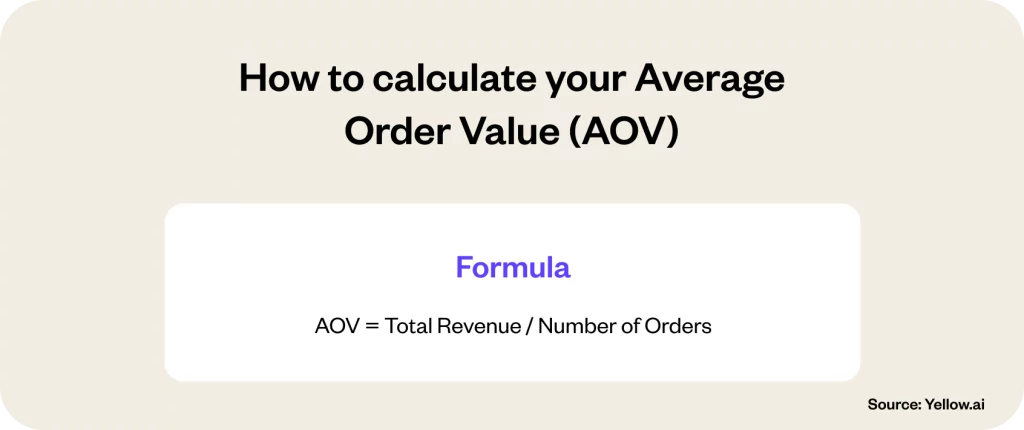

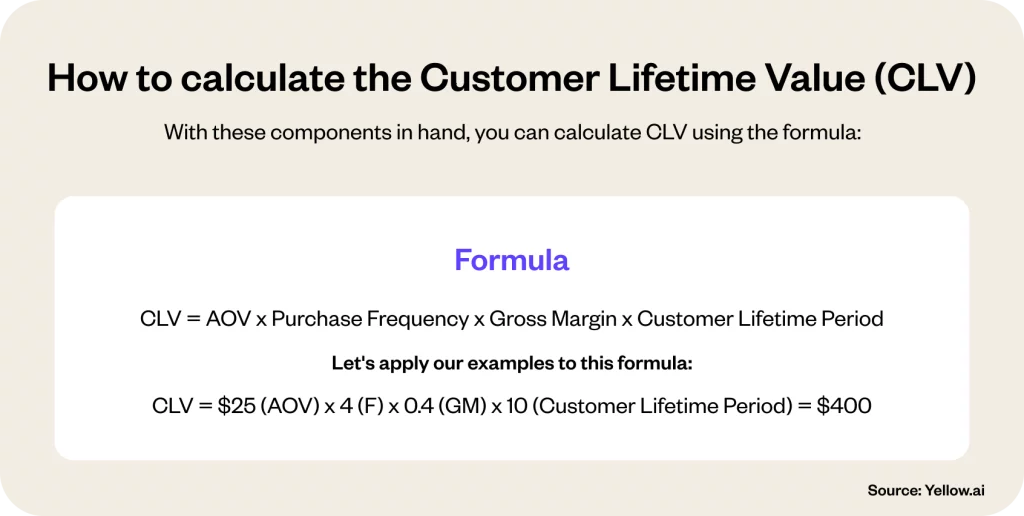

Customer Lifetime Value (CLV) can be a game-changer for businesses with regards to understanding and optimizing customer relationships. To accurately calculate CLV, you first need to grasp its fundamental components, such as Average Order Value, Purchase Frequency, Gross Margin and Customer Lifetime Period.

Here’s a breakdown of the CLV formula and how to calculate each element with examples.

Example: Suppose your business had a total revenue of $500,000 from 20,000 orders last year. Your AOV would be $500,000 / 20,000 = $25. It means, on average, each order placed with your business brings in $25.

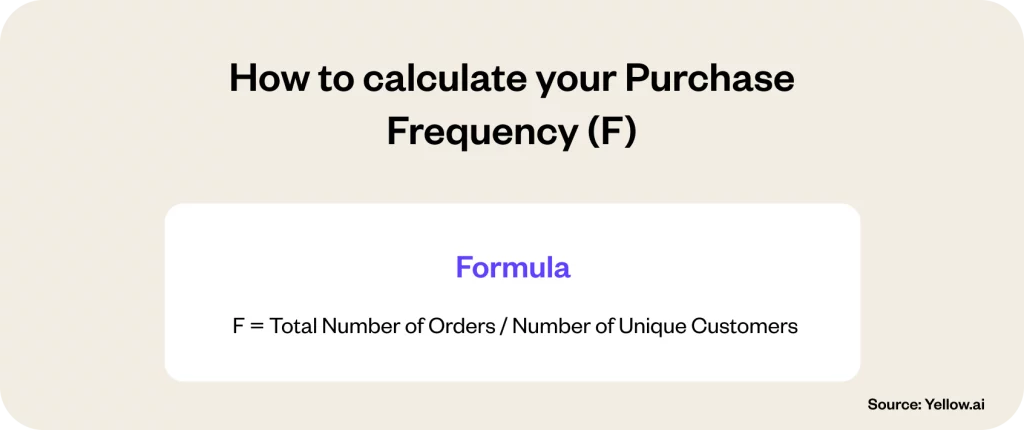

Example: If your business had 20,000 orders last year from 5,000 unique customers, the purchase frequency is 20,000 / 5,000 = 4. It indicates that, on average, each customer made 4 purchases over the year.

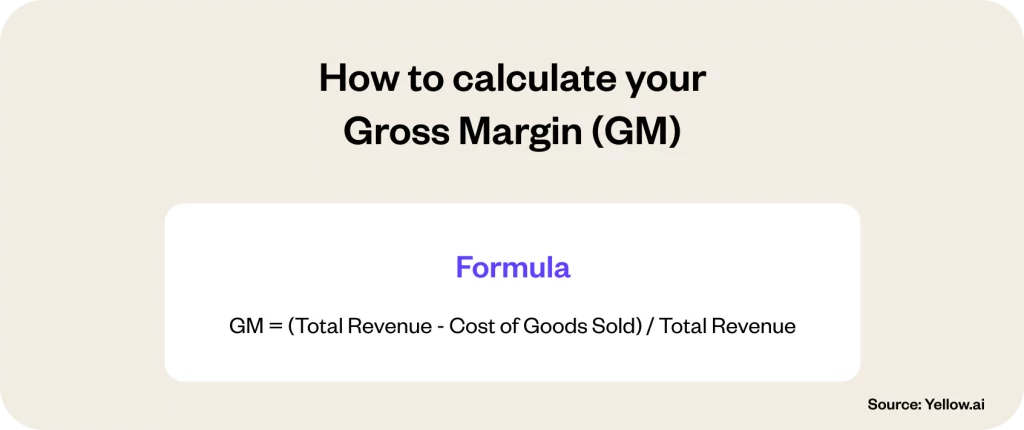

Example: Let’s say your business’s total revenue is $500,000, and the cost of goods sold is $300,000. The gross margin would be ($500,000 – $300,000) / $500,000 = 0.4, or 40%. It represents the profit percentage after accounting for the cost of goods sold.

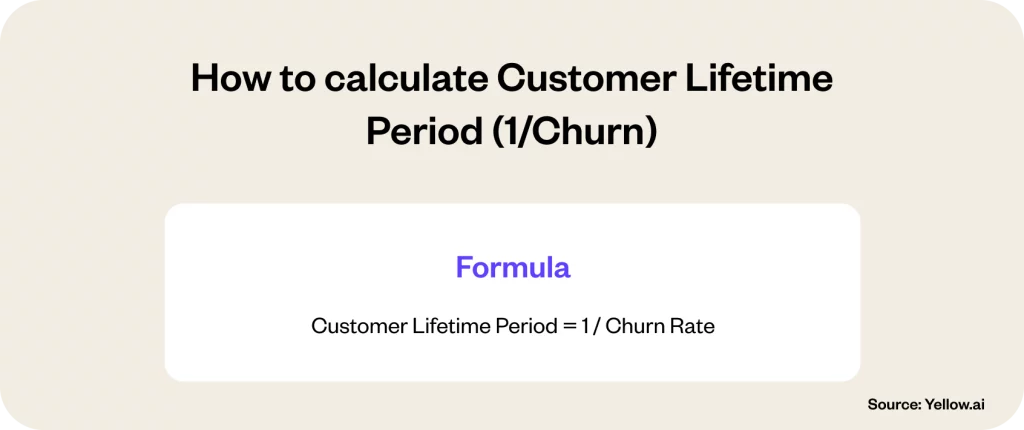

Churn Rate Formula: Churn Rate = (Customers at Start of Period – Customers at End of Period) / Customers at Start of Period

Example: If you started the year with 5,000 customers and ended with 4,500, the churn rate is (5,000 – 4,500) / 5,000 = 0.1 or 10%. Therefore, the Customer Lifetime Period is 1 / 0.1 = 10 years. It means, on average, customers stay with your business for 10 years.

It means each customer, on average, is worth $400 to your business over the course of their relationship with you.

Understanding and calculating CLV is vital for businesses to make informed decisions regarding customer acquisition, retention strategies, and resource allocation. It provides a comprehensive view of how much value each customer brings over their lifetime, enabling businesses to focus on long-term profitability rather than short-term gains.

How to increase customer lifetime value: 10 Effective ways

Customer loyalty is gold, and mastering the art of elevating Customer Lifetime Value (CLV) is essential for any business aiming for long-term success. CLV is more than just transactions; it’s about cultivating an enduring relationship with each customer.

Below are 10 strategies to enhance CLV, ensuring that businesses retain valuable customers.

1. Deepen customer relationships

Building deeper relationships with customers is pivotal. Personalized interactions, understanding their needs, and consistent engagement are essential. Tools like AI-powered chatbots can offer personalized recommendations and support, making each interaction feel unique and valued. Engage customers through various channels, be it social media, email, or in-app communication, to create a bond that transcends transactions.

For example, a business can use AI chatbot analytics to understand customer preferences and tailor communication accordingly. Regular check-ins, personalized offers, and timely assistance can turn a regular customer into a loyal advocate.

2. Implement a loyalty program

Loyalty programs reward customers for their repeat business, encouraging them to continue choosing your brand. These programs can range from simple point-collection systems to complex tiered rewards. Track customer purchases and offer rewards that are both attainable and desirable.

For instance, a retail store can implement a program where customers earn points for each purchase, redeemable for discounts or exclusive products. It will incentivize repeat purchases and also give a sense of belonging and appreciation.

3. Leverage data and analytics

Data-driven insights are crucial for understanding customer behavior and preferences. Utilize analytics tools to gather and analyze customer data, helping you make informed decisions about product offerings, marketing strategies, and customer service improvements.

Imagine a service provider analyzing usage patterns and feedback gathered through AI chatbot’s analytical tools. This information can guide the development of new services or enhancement of existing ones, directly increasing CLV.

4. Offer exceptional customer service

Exceptional customer service can make a significant difference in retaining customers. Implementing AI chatbots for instant responses and support can drastically improve the customer experience. Ensure that your customer service team is well-trained, empathetic, and empowered to solve problems efficiently.

For example, a company using chatbots can provide instant troubleshooting tips or guide customers through complex processes, enhancing satisfaction and loyalty.

5. Encourage upsells and cross-sells

Upselling and cross-selling are effective strategies to increase the value of each customer interaction. AI-powered recommendations can suggest relevant additional products or upgrades based on the customer’s browsing and purchase history.

An e-commerce site, for instance, could suggest complementary products at checkout or offer premium versions of items the customer is interested in, thereby increasing the order value.

6. Create a memorable customer experience

Exceptional experiences are memorable and shareable. Create such experiences at every touchpoint, from browsing to purchasing and after-sales support. Personalize these experiences using data and insights provided by relevant platforms.

For instance, a brand can send personalized messages or offers on special occasions like birthdays or anniversaries, making the customer feel valued and strengthening their connection with the brand.

Related read:

- 10 Essential customer experience KPIs & metrics [2024]

- 10 key customer experience (CX) trends [2024]

- How to personalize customer experiences at scale

7. Invest in customer education

Educated customers are more likely to make informed decisions and feel confident about their purchases. Businesses must create educational content and interactive learning experiences about their products or services.

An example could be a tech company offering webinars and interactive guides, helping customers understand and get the most out of their products.

8. Make it easy for customers to do business with you

Simplifying the purchasing process and making it easy for customers to find what they need can significantly improve CLV. AI chatbots can streamline processes, offer intuitive interfaces, and provide efficient self-service options.

Consider using an AI chatbot to guide customers through the purchasing process, making it a hassle-free and pleasant experience.

9. Embrace feedback and be open to change

Actively seeking and acting on customer feedback is essential. Businesses must gather feedback across multiple channels, analyze it, and implement changes that resonate with their customer base.

For instance, a restaurant chain could use feedback collected to refine its menu or service, constantly adapting to customer preferences.

10. Build trust and transparency

Trust is the foundation of long-term relationships. Be transparent in your dealings, communicate openly about your products and services, and maintain consistent, honest communication. Address issues head-on and provide clear, concise information to build and maintain trust.

An example is a financial services firm sending regular updates about account status or market changes, ensuring customers feel informed and secure in their dealings with the company.

By adopting these strategies, businesses can significantly improve their Customer Lifetime Value. It’s about creating a customer-centric culture, where each interaction is an opportunity to deepen the relationship, enhance satisfaction, and ultimately drive growth.

How does Yellow.ai help to improve customer lifetime value with AI chatbots?

Yellow.ai’s chatbots are like your go-to savvy friends. It makes every customer feel special. These AI chatbots don’t just answer questions; they remember preferences, past chats, and even the little details. It is like having a conversation with someone who really gets you. Each interaction is tailored, making customers feel understood. This personal touch turns one-time buyers into loyal fans, steadily lifting the Customer Lifetime Value (CLV).

And there’s more to these chatbots than just friendly banter. They’re like keen-eyed shopkeepers who know precisely what you’ll love. By intuitively picking up on buying habits and preferences, they nudge customers with suggestions that are just right – maybe a book by a favorite author or a deal on those headphones you’ve been eyeing. It is more than just upselling; it’s about adding value to each customer’s experience, making them come back for more, and naturally boosting the CLV.

Key features of Yellow.ai’s AI chatbot

- Personalized interactions: Utilizing advanced AI, Yellow.ai’s chatbots can engage in meaningful, personalized conversations with customers, addressing their specific needs and queries.

- 24/7 availability: The chatbots are operational round the clock, ensuring that customer inquiries are addressed promptly, regardless of the time.

- Multilingual support: Catering to a global audience, Yellow.ai’s platform can interact in over 135 languages and dialects, breaking down communication barriers.

- Scalability: As your business grows, Yellow.ai’s chatbot scales with you, managing increased customer interactions effortlessly.

- Data analytics: The platform provides valuable insights into customer behavior and preferences, aiding in strategic decision-making.

- Integration capability: Yellow.ai’s chatbots can be integrated with existing CRM systems, streamlining data management and enhancing customer experience.

Discover how Yellow.ai can transform your customer support system.

The final thoughts

Understanding and enhancing CLV is more than just a strategy; it is a commitment to nurturing enduring customer relationships. The insights and strategies discussed in this blog offer a blueprint for businesses to understand the lifetime value of their customers and to elevate it, fostering a cycle of mutual growth and loyalty.

The journey of understanding and optimizing CLV is an ongoing one, filled with learning and adaptation. It calls for a commitment to understanding customers beyond the surface level and integrating this knowledge into every business decision. As we advance, let’s embrace this approach, recognizing that the actual value of a customer is not just in what they spend today but in the potential they hold for the future.

Frequently asked questions (FAQs)

What are the three parts of customer lifetime value?

The three critical components of Customer Lifetime Value (CLV) are Average Order Value (AOV), Purchase Frequency (F), and Customer Lifespan (L). AOV represents the average amount spent in a transaction, Purchase Frequency indicates how often customers make a purchase, and Customer Lifespan is the average duration a customer remains with the business.

What is an example of customer lifetime value?

An example of CLV could be a subscription-based service where a customer pays $10 monthly and stays with the service for an average of 3 years. The CLV would be $10 (monthly subscription) x 12 (months) x 3 (years) = $360.

How can you increase customer lifetime value?

To increase CLV, focus on enhancing customer satisfaction, implementing loyalty programs, personalizing customer experiences, offering quality products/services, and maintaining consistent communication. Leveraging data analytics to understand customer behavior and preferences is also crucial.

Why is customer lifetime value important?

CLV is crucial as it helps businesses understand the long-term value of customers, guiding strategies in marketing, customer service, and product development. It aids in resource allocation, improving customer retention, and identifying high-value customers.

How do I calculate LTV for a customer?

To calculate the Lifetime Value (LTV) for a customer, use the formula: LTV = Average Order Value (AOV) x Purchase Frequency (F) x Customer Lifespan (L). This formula gives you the total revenue you can expect from a customer over their relationship with your business.