Executive summary

Customer experience in banking has emerged as a cornerstone for success and differentiation. This blog delves into the nuances of customer experience management in banking, emphasizing its significance in digital transformation. We’ll explore key facets, including customer experience trends in banking, the evolving expectations in digital and commercial banking experiences, and the role of innovative technologies in shaping these experiences.

As the financial world marches into 2024, banks and financial institutions find themselves at a crossroads. Gone are the days when banking was just about transactions and account balances. Today, in a world where digital convenience is king, customer experience in banking has ascended to the throne. It’s not just about providing services. It also covers other essential aspects, such as crafting journeys, weaving emotional connections, and personalizing interactions at every touchpoint.

Research shows that banks prioritizing customer experience see a 10-15% growth in revenue and a 20% rise in customer satisfaction rates. But what does it take to transform from a traditional institution to a customer-centric powerhouse in today’s digital age? This blog doesn’t just answer that question; it furnishes a roadmap. From dissecting the trends shaping customer expectations to unveiling the strategies that can put your institution ahead, we’re diving deep into the heart of customer experience in banking – where every click, conversation, and transaction can turn a customer into a lifelong advocate.

Related must-reads:

- Customer experience vs. customer service

- How to improve customer experience? [Complete Guide]

- Digital customer experience – Why it matters in 2024

- AI and automation in customer experience

What is customer experience (CX) in banking?

Customer experience (CX) in banking transcends the traditional boundaries of mere service delivery. It encompasses the entire gamut of a customer’s journey and interactions with a bank or financial institution. From the moment they log into their online banking portal to the interactions at a branch, each touchpoint contributes to their overall perception and satisfaction.

In banking, CX is the space where financial services meet customer expectations. It’s not just about the functionality of banking products or the efficiency of transactions. It also focuses on the emotional resonance and convenience that these services bring into customers’ lives. Whether navigating a mobile banking app, seeking advice from a customer service representative, or receiving personalized financial advice, every interaction is a piece of the larger puzzle that forms the customer experience.

Related read: Banking automation – How is AI transforming the BFSI sector

One can’t ignore the effectiveness of CX in the banking sector. In today’s digital age, where customers are empowered with choices and information, banking institutions are not just competing based on financial products, but also on the quality of customer experiences they deliver. A superior CX is a powerful differentiator in an industry that’s rapidly becoming commoditized. It’s a vital element that can propel customer loyalty, satisfaction, and, ultimately, the financial institution’s growth.

The evolution of customer experience in banking is also a reflection of changing customer needs and technological advancements. Customers now expect a seamless blend of digital convenience and personalized service. They seek banking experiences that are not only secure and reliable but also intuitive and tailored to their individual needs. In response, banks are turning towards innovative technologies like AI, machine learning, and advanced analytics to deliver these enriched experiences. The evolution of customer experience in banking also reflects the altering customer needs and technological advancements. Today’s customers expect a seamless convergence of digital convenience and personalized service. They seek secure, reliable, and intuitive banking experiences, apart from tailored services to their needs. Banks are turning towards innovative technologies such as AI, machine learning (ML), and advanced analytics to deliver these enriched experiences.

Importance of customer experience in banking

Customer experience (CX) stands as a lighthouse guiding banks and financial institutions towards sustainable growth and customer loyalty. The importance of CX in the banking sector cannot be understated. It is the heartbeat of every successful banking operation, pulsating through every service and interaction.

1. Creating competitive differentiation

In an industry where products and services are increasingly commoditized, CX becomes the battleground for differentiation. Unlike traditional banking paradigms that relied on interest rates or branch locations to attract customers, today’s digital era demands a more nuanced approach. Superior customer experience is the new currency in the banking sector. It turns first-time users into lifelong customers and indifferent customers into vocal advocates.

2. Driving customer retention and loyalty

The cost of acquiring a new customer is relatively higher than retaining an existing one, making customer loyalty an invaluable asset. Exceptional CX in banking is not just about satisfying customers; it’s about delighting them at every juncture. From seamless online banking interfaces to empathetic and effective customer support, each element reinforces customer trust and loyalty. Satisfied customers tend to explore additional services, increasing their lifetime value to the institution.

3. Meeting evolving customer expectations

Today’s banking customers aren’t the same as a decade ago. With technological advancements and the rise of digital platforms, customers now expect banking experiences that are not just transactional but also personalized and convenient. Banks that cater to these expectations through innovative CX strategies are better positioned to attract tech-savvy and discerning customers who value ease of use and personalized services.

4. Enhancing brand reputation and market position

A strong focus on customer experience reflects positively on the bank’s brand image. Positive customer stories can significantly bolster a bank’s reputation in a digital world where experiences are shared widely and quickly. Conversely, negative experiences can harm a bank’s brand and deter potential customers. By prioritizing CX, banks create a favorable narrative around their brand, which resonates well in the market and helps to attract new customers.

5. Leveraging data for strategic insights

CX in banking is not just about surface-level changes; it’s deeply integrated with data analytics and customer insights. Banks leveraging CX strategies can gather valuable data about customer behaviors, preferences, and pain points. This data, in turn, drives strategic decisions, enabling banks to tailor their services more effectively and anticipate market trends.

Harnessing the power of conversational AI in transforming customer experience in banking

Download Whitepaper

Common customer expectations for the digital banking experience

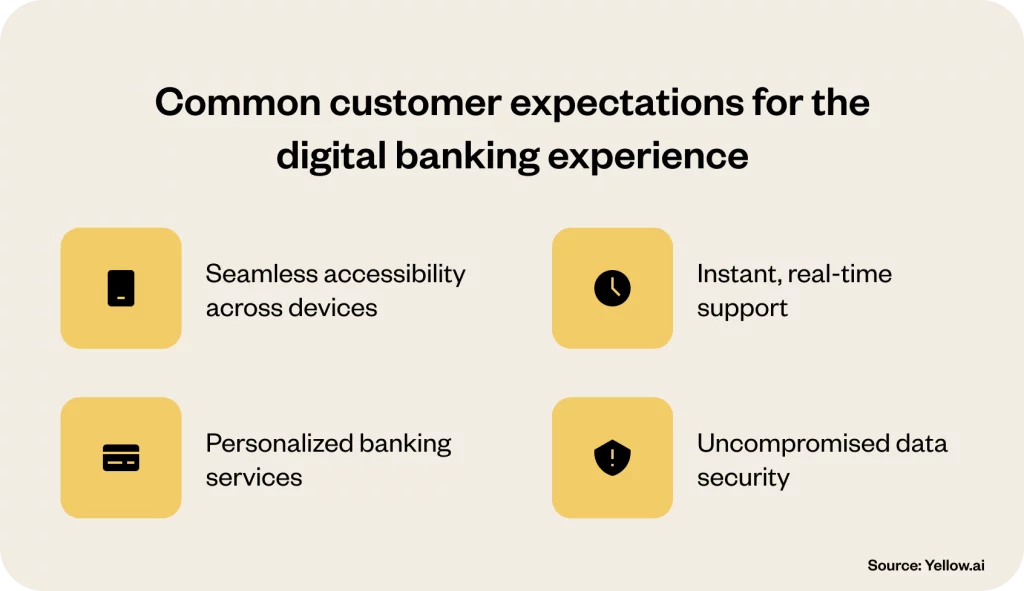

Customer expectations are not just increasing in the banking industry; they are transforming. As technology advances and personalization becomes the norm in various industries, customers’ demands for their digital banking experience are also becoming more precise and sophisticated. Financial institutions aiming to remain competitive and relevant must understand these expectations. Let’s delve into what customers are looking for in their digital banking journey:

1. Seamless accessibility across devices

Let’s face it: we’re all glued to our smartphones, right? It’s no surprise that when it comes to banking, we want it snappy and handy. Picture this: you’re lounging on your couch, and with just a few taps on your phone, you’ve paid your bills. That’s the kind of technology we’re talking about. People aren’t just settling for basic features anymore. They crave a banking experience that’s like having a financial wizard in their pocket – smart, smooth, and straightforward. Whether you’re swiping through your tablet or clicking away on your desktop, the experience should feel like a breeze. No headaches, no fuss – just your banking needs met with ease of operation.

2. Instant, real-time support

The digital era has accelerated expectations for immediate assistance. Customers want real-time support for their banking needs, with surveys showing that quick support is a critical factor in building loyalty. Financial institutions can meet this expectation by integrating live assistance tools such as co-browsing and video chat. Additionally, deploying advanced chatbots can help scale support, providing instant answers to common queries and freeing up human agents for more complex issues.

3. Personalized banking services

Personalization is no longer a luxury; it’s a necessity. Customers prefer banking services customized to their unique needs and occasions. It goes beyond just addressing them by name in emails or messages. Banks must offer personalized product recommendations, financial advice, and banking solutions based on their spending habits, lifestyle, and financial goals. Banks succeeding in leveraging customer data to provide such individualized experiences will significantly enhance customer satisfaction and loyalty.

4. Uncompromised data security

Security holds utmost importance in the digital banking sphere. Customers need assurance that their sensitive financial information remains guarded against breaches and fraud. Trust is vital for strengthening customer-bank relationships. Thus, the latter must demonstrate their commitment to data security through robust safety measures. A few key steps include secure encryption methods, two-factor authentication, and regular security updates. Educating customers about security features and practices also builds trust and reassures them of the bank’s commitment to safeguarding their financial data.

Empower your customers with a support experience like no other

Banking customer experience trends for 2024

The banking sector is witnessing a significant shift in customer experience (CX) trends, driven by rapid digital transformation and evolving customer expectations. As we venture into 2024, these trends are reshaping the way banks operate and redefining the standards of customer engagement and loyalty.

Let’s explore the key CX trends in banking for the upcoming year:

1. Enhanced online and mobile customer service

The shift towards digital banking is undeniable. A Deloitte study revealed that 84% of customers use online banking, while 72% utilize mobile banking apps. However, the challenge lies in the effectiveness of digital support channels.

The Financial Brand study found that 64% of customers reported inadequate support in mobile banking apps, indicating a significant gap in digital customer service.

Large-scale banks are setting new standards by offering round-the-clock customer service through various channels, including in-app live chat and social media, significantly boosting their Net Promoter Scores. This trend underlines the importance of banks offering robust, responsive, and user-friendly digital customer service to meet and exceed customer expectations.

2. Personalized experiences boosting retention

Personalized experiences are becoming increasingly important in retaining customers. Banks are now leveraging customer data for tailored services. According to a Zendesk report, 72% of customers consider personalization crucial in financial services. Moreover, 77% of business leaders recognize that deeper personalization enhances customer retention.

3. AI efficiency balanced with human interaction

While AI and automation enhance operational efficiency, the human element remains vital, especially for complex customer issues.

The Zendesk CX Trends Report indicates that 59% of business leaders see measurable ROI from AI investments, but 63% of consumers still prefer personal interactions for important banking tasks.

4. Rise of conversational experiences

Consistency across communication channels is increasingly critical. Customers expect seamless conversational experiences that maintain context across channels.

Related read: 6 Examples of conversational AI in banking

Deloitte’s research found that 70% of consumers view a consistent experience across channels as extremely important in choosing their primary bank.

5. Emotional connections cementing loyalty

Building emotional connections is key to fostering customer loyalty in banking. Forrester’s research found that feeling valued is the strongest loyalty driver in banking. Among direct banking customers who feel valued, 87% express loyalty, with similar trends in multichannel banking.

As we look ahead, these trends suggest a transformative phase for the banking industry, where digital innovation, personalized experiences, and emotional engagement are set to become the hallmarks of successful customer experience strategies. Banks that embrace these trends and adapt to the dynamic CX landscape will be well-positioned to thrive in 2024 and beyond.

Examples of banks with outstanding customer experience (CX)

Here’s a look at some of these trailblazing banks, each showcasing unique strategies and innovations in enhancing customer satisfaction and engagement.

1. Capital One: Pioneering in digital innovation

Capital One has consistently topped the charts in customer satisfaction, owing much of its acclaim to its relentless focus on digital CX enhancement. Known for its integration of digital wallets and contactless payment options, it has also incorporated advanced natural language processing in its AI assistant.

Their recent partnerships with major e-commerce players like Amazon and Walmart through rewarding programs have been a game-changer, offering customers more value from their regular spending.

2. TD Bank: ‘America’s most convenient bank’

TD Bank lives up to its tagline with over 1,200 branches, extended hours, and a customer-first approach. It’s not just their physical presence that’s commendable; they also utilize data analytics to refine their digital and omnichannel experiences.

Their seamless integration of digital tools with in-branch services exemplifies a balanced approach to modern banking.

3. Ally Bank: The online banking leader

Since its inception, Ally Bank has excelled in the online retail banking sector. Noteworthy for their 24/7 customer service, no minimum deposit requirements, and an interactive AI assistant, Ally Assist, they’ve consistently led in digital banking.

Ally’s commitment to using data for hyper-personalization and more realistic AI interactions highlights its focus on tailor-made customer experiences.

4. PNC Bank: Hybrid banking experience

PNC has distinguished itself by offering a hybrid experience that combines an extensive branch network with cutting-edge digital money management tools. Its Virtual Wallet app is a testament to its innovative approach to banking.

PNC goes the extra mile with customer-centric features like customizable ATM withdrawal denominations, enhancing everyday banking convenience.

5. JPMorgan Chase: Setting the bar high

As the leading bank in the United States by asset size, JPMorgan Chase is renowned for its swift client support, all-encompassing mobile banking application, and no-cost internet bill payment feature. The bank distinguishes itself with a strong emphasis on digital literacy and client interaction, exemplified by initiatives like the ‘Hart of It All‘ series featuring Kevin Hart, which brings an innovative flair to their offerings.

Regularly achieving top positions in J.D. Power’s customer satisfaction surveys, JPMorgan Chase demonstrates an unwavering dedication to superior customer service.

How to improve the customer experience in Banking

Improving the customer experience in banking is pivotal for institutions looking to thrive in the competitive financial landscape of 2024. As digital transformation reshapes the industry, banks must transform their strategies to suit the evolving customer needs. Here’s a breakdown of effective approaches for enhancing customer experience:

1. Utilizing self-service for scalability

The banking sector has seen an exponential rise in self-service adoption. This approach drives efficiency and reduces overhead costs by allowing support teams to focus on more complex customer inquiries.

A comprehensive self-service strategy, including an accessible knowledge base, can empower customers to handle routine transactions and inquiries independently. This autonomy in managing their banking needs enhances customer satisfaction and streamlines the onboarding process, ensuring they derive maximum value from your services.

For instance, implementing self-service models for common banking activities like bill payments, credit limit modifications, and travel notifications can significantly improve customer engagement, as evidenced by some leading banks.

2. Modernizing the contact center

A significant challenge for banks is transforming their contact centers to leverage customer data effectively. Often, outdated systems hinder the ability to understand customer patterns and preferences.

Banks can gain deeper insights into customer interactions across various channels by investing in modern support software and CRM solutions. This integration enables personalized service offerings, fostering better customer relationships and creating opportunities for revenue growth.

Modern contact centers equipped with advanced systems can provide agents with comprehensive customer profiles, facilitating personalized interactions and fostering a more engaging customer experience.

3. Ensuring immediate customer support

Banking customers today prioritize convenience and are willing to invest more for immediate support. Quickly responding to inquiries, especially in mobile banking, is crucial for customer satisfaction.

Banks must ensure that support is readily available across all channels, enabling customers to receive assistance without unnecessary delays. This approach is essential for high-stakes financial decisions, such as loan applications, where customers prefer human interaction.

By employing advanced workflows and routing strategies, banks can prioritize urgent customer inquiries and high-value clients, promptly directing each customer to the appropriate agent.

Related read: Customer support: Example, types, challenges, and strategy

Why Yellow.ai is the best platform for AI-powered chatbots?

It’s crucial to focus on the role of AI-powered chatbots in the banking sector. Yellow.ai is a standout platform in the AI chatbot technology landscape, especially for Banking, Financial Services, and Insurance (BFSI). So, why does Yellow.ai deserve your attention? Here are the compelling reasons:

Real-time, omnichannel support: Yellow.ai isn’t just about automation; it is intelligent, 24/7 customer engagement across all channels. Imagine providing your customers personalized banking support anytime, anywhere – that’s what Yellow.ai offers.

Leading Generative AI for businesses: Yellow.ai’s journey to 100+ gen AI bots & millions of messages

Read more

Cost efficiency and lead generation: Reducing operational costs by 60% while increasing lead generation by 25% is not a mere claim but a reality with Yellow.ai. This dual benefit of cost-saving and revenue generation is a game-changer for any financial institution.

Fast and human-like interactions: Thanks to its advanced conversational AI, Yellow.ai delivers quick, smart, and human-like support, transforming your customer support from a cost center into a revenue generator.

Dynamic voice AI for personal interactions: Say farewell to robotic interactions. Yellow.ai’s voice AI can handle a range of banking queries with the finesse of natural, human-like conversations, adding a personal touch at scale.

Boosting sales: With Yellow.ai, increase your sales of financial products across multiple channels. Its features, like eligibility checkers and product comparisons, are designed to triple your sales conversions.

Targeted personalized offers: Utilize customer insights to launch customized campaigns with Yellow.ai, boosting bank leads by 25% and fostering long-term loyalty.

Rapid implementation: With BFSI-specific pre-built templates, deployment is swift, ensuring you can offer enhanced customer support without delay.

AI-enhanced human agents: Yellow.ai also boosts the performance of your human agents by providing AI-generated insights and suggestions, ensuring customer satisfaction soars by 40%.

Continuous improvement: The platform offers performance insights, enabling you to evolve and refine your customer service continually.

Are you interested in experiencing this transformation?

The final word on CX in banking

The landscape of customer experience in banking is undergoing a revolutionary transformation. The evolution of this sector is irrepressible. The future of banking is digital, personalized, and customer-centric.

Adopting these changes is not optional but a necessity to survive and thrive. Integrating advanced technologies like AI and the implementation of strategic customer experience initiatives will be crucial. Institutions that adapt, innovate, and focus on delivering exceptional customer experiences will flourish and set new standards in the banking sector. The journey towards enriching customer experience in banking is an ongoing one, with boundless possibilities for innovation and improvement.

Frequently asked questions (FAQs)

What is customer experience in the banking industry?

Customer experience in the banking industry spotlights the entire spectrum of a customer’s interactions and perceptions of a bank or financial institution. It includes everything from using digital banking apps and online services to interacting with customer support and visiting physical branches. Such a range of experiences shapes the customer’s overall satisfaction, loyalty, and opinion about the bank’s brand.

Why is customer experience important for banks?

Customer experience is vital for banks as it’s a key differentiator in an increasingly competitive market. Exceptional customer experience leads to higher customer satisfaction, loyalty, and retention. It also influences the bank’s reputation, attracts new customers, and can significantly impact revenue growth and market share. Good customer experience is paramount for banks. It works as an integral distinguisher in a highly competitive market. Outstanding customer experience results in enhanced customer satisfaction, loyalty, and retention. It can also build the bank’s image, attract new customers, and significantly influence revenue generation and market share.

How can banks improve customer experience?

Banks can improve customer experience by offering personalized services and enhancing digital banking platforms for ease of use and accessibility. Likewise, it must provide efficient and empathetic customer support and ensure data security. Additionally, integrating AI and advanced analytics for deeper customer insights and personalization can significantly enhance the banking experience.

What is the role of customer service in the banking sector?

Customer service is crucial in the banking sector as it directly affects customer satisfaction and loyalty. Effective customer service involves addressing customer queries and issues promptly and providing personalized advice and support. It’s about creating positive experiences at every interaction, thereby strengthening the customer’s trust and relationship with the bank.