Analytics

Channels

Human + AI

Safe AI

Integrations

Channels

Telephony

Use Cases

Call Center Agent

The company expected a drop in policy verification and collections as an aftermath of the pandemic. They were looking for an innovative solution that would help them optimize the customer outreach during the pandemic & reduce operational cost whilst offering superior customer experience.

1

Multilingual Voice Bot

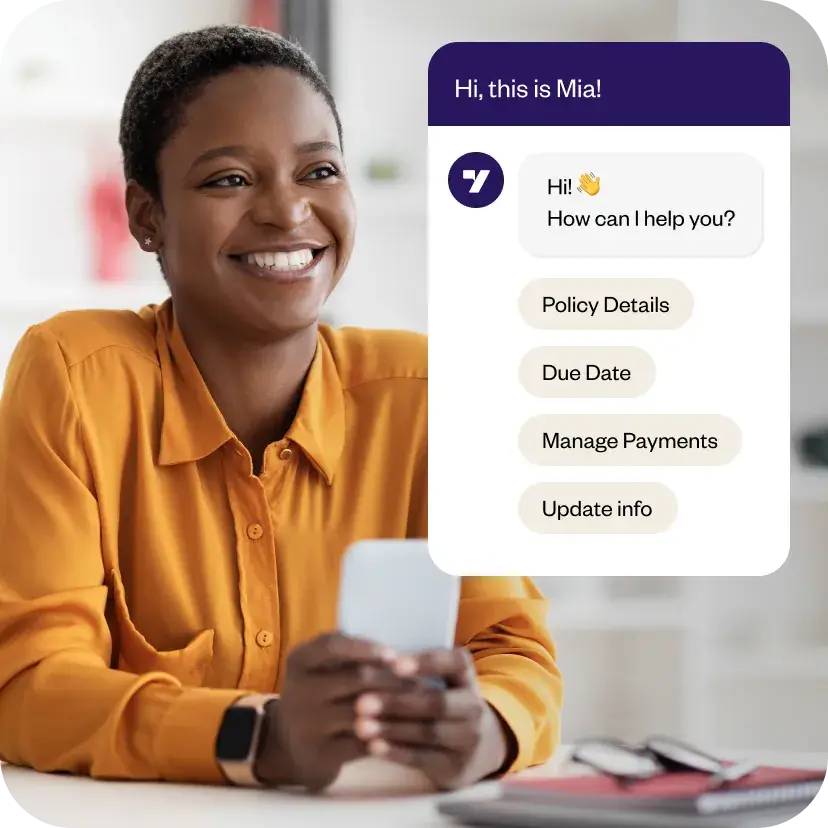

We built a multilingual voice bot that would help users verify policy details, check policy due date, manage payments, update customer information, set premium due date reminders and more seamlessely.

2

Smooth integrations

The bot was integrated with client systems including policy administration, policy management & billing to offer seamless and personalized experience to users. We removed the need of hopping from one application to another, and made it all possible from a single interface.

3

Context based intent resolutions

The multilingual bot had superior context based intent identification to help understand queries better and provide insights from customer interaction to help constantly improve bot performance and understand consumer behaviour. Thus, it wasn’t just a support bot but provided real time resolutions, leading to happier customers.

COST SAVINGS

0

%reduction in operational costs

HIGH EFFICIENCY

0

%higher bot efficiency compared to live agents

IMPROVED REACH

0

XScaling capacity