Artificial Intelligence (AI) is causing a stir in the world of finance. The financial services industry, which is largely reliant on data and is afflicted with legacy processes, is increasingly adopting AI-powered solutions and leveraging its strong capabilities.

In this blog we’ll look at some important use cases of AI in the finance sector and what the future looks like for this rapidly evolving industry.

Use cases of artificial intelligence (AI) in the finance industry

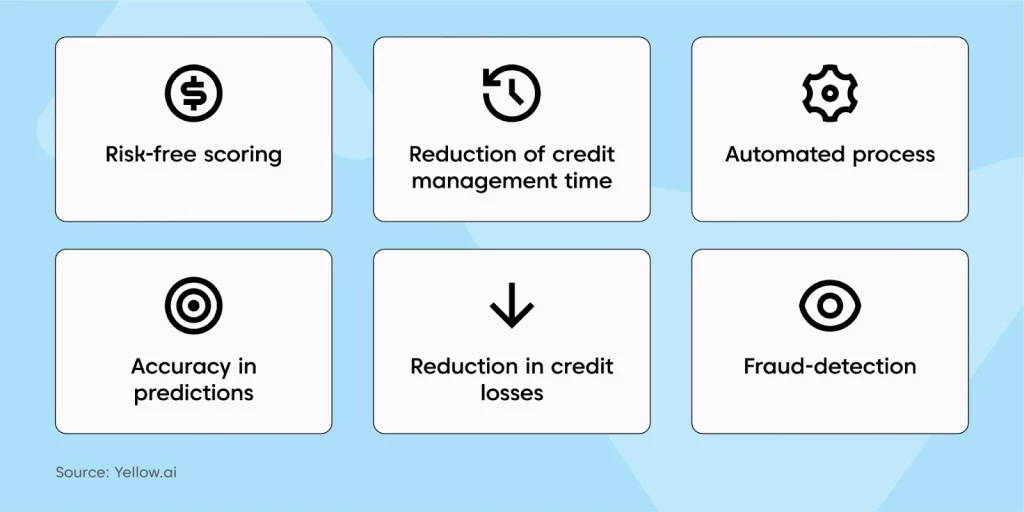

1. Loan eligibility calculation with AI-powered credit scoring

Is it possible to utilize artificial intelligence to decide whether or not a person qualifies for a loan? Definitely! Infact, banks and financial institutions are increasingly employing AI and machine learning algorithms to not only identify a person’s loan eligibility, but also to present customized solutions. What’s the benefit? AI isn’t prejudiced, so it can make a more accurate and timely judgment of loan eligibility.

2. Risk management with complex data analysis

In the finance industry, risk mitigation is always a significant and continuous concern. The ability of AI in finance to analyze large amounts of structured and unstructured data can improve risk management and compliance capabilities. Thus, enabling risk managers in financial institutions to identify risks more effectively and timely to make more informed decisions.

3. Fraud detection and prevention with automatic risk triggers

72% of business leaders cite fraud as a growing concern over the past 12 months. Rapid digital transformation has exacerbated data issues – causing data silos and overload – resulting in an inadequate view of risk exposures. This makes it difficult to spot patterns and trends that are necessary for fraud detection.

AI is enabling BFSI companies to proactively prevent fraud, instead of reactively approaching the issue. Fraud detection systems that use artificial intelligence can sift through large amounts of customer data in real-time to find patterns that can be used to detect fraud. When fraud is suspected, AI models can be used to either reject or flag transactions for further investigation.

4. Credit decisions with automated risk assessment

Processing loan applications is often a time-consuming and laborious procedure, making it difficult for banks to meet their customers’ needs for faster response times. In order to make the credit process more agile and fair, finance AI can be employed in a variety of ways.

Artificial intelligence in finance can assist lenders in more correctly assessing a borrower’s risk. It can do so by looking at information that isn’t included in a typical credit score, such as whether the borrower spends money on needs or luxuries. AI could also assist lenders in identifying hidden risk factors – whether a borrower is using too much of their available credit.

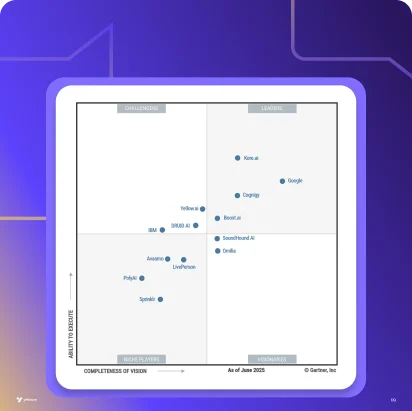

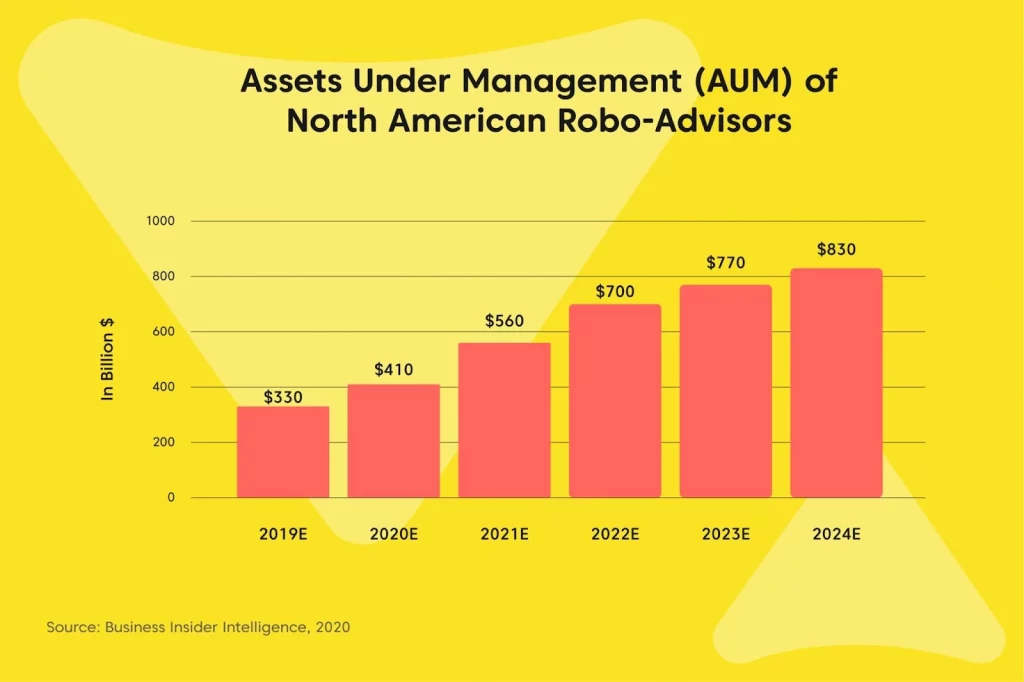

5. Financial advisory services with intelligent virtual assistants

Conversational AI bots or robo-advisors offer algorithm-driven financial planning services with little to no human supervision. They can keep customers informed about the latest financial trends, help them grow their portfolios, achieve tax efficiency, maximize savings and so much more.

AI-powered assistants can also analyze customers’ spending habits and offer personalized recommendations to improve their financial health.

6. Algorithmic trading with real-time data mining

Artificial intelligence is frequently utilized in trading since it is capable of analyzing trends within massive data sets. AI-driven algorithms can sift through millions of data points and execute trades at the optimal price, forecast markets more accurately and efficiently minimize risk for higher profits.

7. Personalized banking with AI-enabled chatbots

AI Chatbots and virtual assistants have decreased (and in some cases eliminated) the need to wait on hold to talk to a customer support rep on the phone.

Customers can now check their balances, schedule payments, look at account activity, ask questions from an AI-powered virtual assistant, and get personalized banking advice whenever it’s most convenient.

8. Security with agile risk spotting

Consumers want assurances that their money and personal information will be kept as safe and secure as possible, and artificial intelligence can help. Human mistake is thought to be responsible for up to 95% of cloud breaches.

Artificial intelligence can help businesses improve their security by studying and identifying normal data patterns and trends, as well as alerting agents about any anomalies or suspicious activities.

9. Claims processing and settlement with insurance chatbots

Settlement of claims requires the involvement of providers, adjusters, inspectors and agents. It’s a tardy process that takes around 30 days or sometimes even more. Meanwhile, the customers have to constantly follow up with a customer rep to check the status of the claim.

With the help of AI-enabled bots, making and checking up on claims is as easy as it gets. Policyholders just have to tell about the nature of the claim. The bot then asks for a few additional details, pulls up the customer’s policy from the company’s CRM and immediately initiates the claims filing process.

10. Customer data management with automated data structuring

When it comes to banks and financial institutions, data is the most valuable resource, hence effective data management is critical to the business’s growth and success.

The huge volume and structural diversity of financial data, which includes mobile communications, social media activity, transactional details and market data, makes manual processing difficult even for financial experts.

Using AI-powered data and document processing solutions can improve process efficiency while also allowing actionable intelligence to be extracted from the data. Data analytics, data mining, and natural language processing are examples of AI and ML solutions that assist businesses gain important insights from their data.

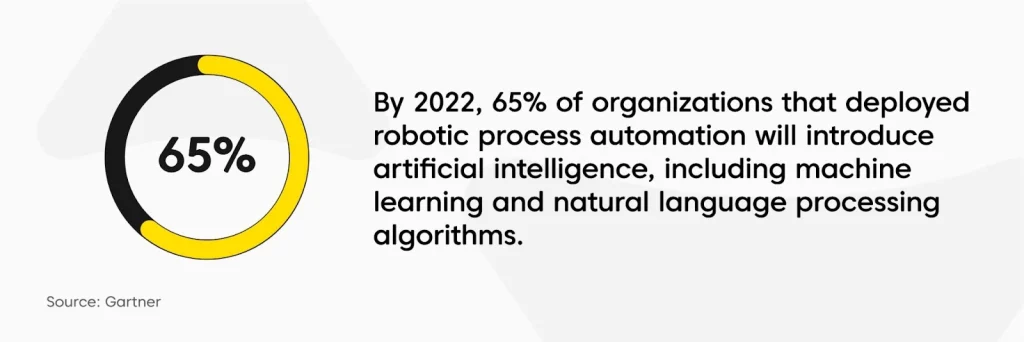

11. Business process automation with AI and RPA integration

BFSI companies can use finance AI solutions to automate repetitive, manual operations, resulting in increased business efficiency.

AI solutions can also be integrated with your internal enterprise systems to make sure bots and agents have access to as much data as possible. This allows financial institutions to enhance their customer experience, cut expenses, and scale their services.

12. Data-driven underwriting with big data analytics

Insurers can use AI-based underwriting solutions to improve risk management and pricing. Underwriters can now leverage a wider range of data sources for their evaluations, including social media and news feeds, credible information from public sources, and third parties, thanks to AI.

Big data analytics provide better visibility of clients’ risk profiles, allowing premiums to be tailored to each customer’s actual risk. Also, the ability to drastically shorten underwriting workflows from several weeks to a few seconds can be a game changer for the industry.

13. Customer self-service with AI-powered bots

Artificial Intelligence has proven to be beneficial when it comes to offering additional benefits and comfort to individual users. AI-powered finance chatbots act as the perfect self-help option for customers. They not only decrease the workload for agents but also deliver more accurate information to customers 24/7.

Future of artificial intelligence (AI) in Finance

Financial Institutions are undergoing large-scale modernization projects that are often still hampered by aging technology infrastructure for example as of mid-2019, as many as 70% of banks were still reviewing their legacy core banking platform implementations, and 43% of US banks were still using a coding language dating to 1959.

Heightened competitive pressures due to Covid-19 have nudged BFSI companies towards digitalization but the adoption seems to be slow as compared to other industries. In the future, we can expect more companies to make radical changes to their operating models.

Another area where AI will create opportunities in the financial industry is in providing access to credit to the underserved population. Banks will maximize data usage to start delivering services to the “credit invisible,” unleashing financial support for individuals without traditional credit histories. Thereby, creating a more equitable environment for consumers to access capital.

To sum up

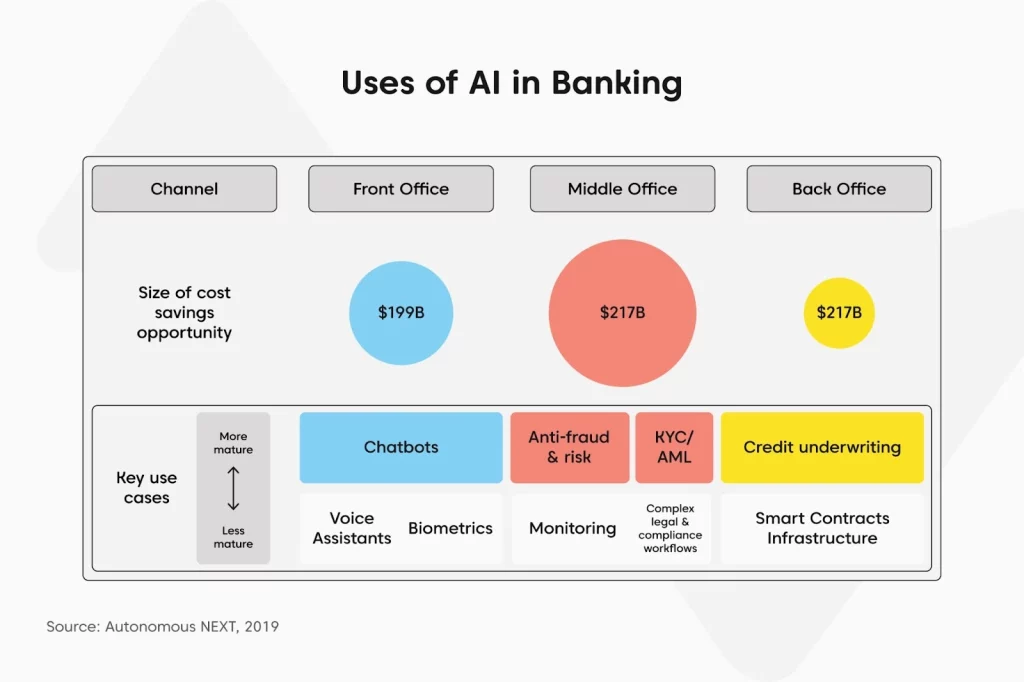

From chatbots to fraud detection, AI is being used in the BFSI industry to not only automate processes and expedite operations in the front and back offices but also to improve the overall user experience.

With its superior analytical capabilities and ability to process vast amounts of data, AI is rapidly being employed in the finance sector to make faster and more efficient credit, investment, and business decisions.

If you are looking for an automation partner who can help you modernize your help desks and solve core business problems with customized AI solutions, then you are at the right place. Yellow.ai has helped BFSI giants such as Bajaj Finserv elevate their total user experience and save up to $16 million a year in operational costs.

Get in touch with our experts to learn more about how you can leverage AI-powered automation to unlock new levels of business growth and efficiency.