Executive summary

Grasping the churn rate is crucial for businesses focused on growth and retaining customers. This blog offers insights into defining the churn rate, calculating it effectively, and strategies for minimizing it. With practical advice and clear explanations, businesses can identify why customers leave and implement measures to keep them engaged. It’s about turning data into actionable insights to foster loyalty and boost your bottom line.

Introduction

The stark reality that 73% of consumers are one or two bad experiences away from switching allegiances underscores the urgency for businesses to understand and address customer churn. This metric, simple in concept yet profound in impact, offers a clear lens through which the health of customer relationships can be assessed. It’s a wake-up call, reminding us that in the bustling marketplace, the fight for customer loyalty is relentless.

Embarking on the quest to minimize churn, businesses find themselves at the intersection of data analytics and empathetic customer engagement. Here, AI and modern technologies are invaluable allies. They enable a deeper dive into the reasons behind customer departures. This blog aims to decode the layers of churn rate management, blending statistical insights with human-centric strategies to forge stronger, lasting connections with customers. Read on to navigate the path to turning potential departures into opportunities for enhancement and growth.

What is the customer churn rate?

Understanding the dynamics of customer retention and loss is crucial in the business arena. That is where the concept of customer churn rate comes in. It is a critical metric that casts a spotlight on the rate at which a business loses its customers over a specific period. It is often depicted as a percentage, representing the proportion of clients who have ceased their association with a service or subscription within a designated time frame. For businesses aiming for growth, it’s pivotal that the influx of new customers counterbalances and ideally surpasses the churn rate.

The significance of churn rate extends beyond a mere statistic; it is a barometer for customer satisfaction, loyalty, and overall company health. A high churn rate signals alarm, potentially indicating underlying issues such as subpar service quality, lack of engagement, or competitive disadvantages. Conversely, a low churn rate suggests a loyal customer base and a business that meets, if not exceeds, customer expectations. While what constitutes a “good” or “bad” churn rate can oscillate widely across different industries, the universal aim is to minimize it, enhancing customer retention and thereby securing revenue stability.

For businesses, grappling with churn rate is beyond just numbers. It is about understanding the stories behind the departures. Each lost customer is a narrative of unmet needs or expectations, offering invaluable insights into areas ripe for improvement. Reducing churn rate, therefore, is synonymous with augmenting customer satisfaction and loyalty, underscoring its paramount importance in strategic business planning. In essence, mastering the churn rate is mastering the art of customer retention, a crucial determinant in the long-term success and sustainability of any business.

Benefits of knowing your customer churn rate

Knowing your customer churn rate is a crucial insight that can significantly influence your business’s direction and success. This understanding opens up several benefits, making it an invaluable asset for strategic decision-making. Let’s explore the tangible advantages of getting to grips with your churn rate and how it can empower your business.

Sharpening marketing strategies

Your churn rate is like a litmus test for the effectiveness of your marketing efforts. It helps pinpoint whether your strategies are hitting the mark or missing it entirely. A rising churn rate post-campaign signals a need to revisit and refine your approach. This direct feedback loop enables you to craft marketing initiatives that not only attract customers but keep them engaged and loyal.

Boosting customer retention

Reducing churn is financially smarter than constantly acquiring new customers. It’s more cost-effective to keep the customers you have, as finding new ones can be significantly more expensive. A stable churn rate indicates your business is on the right track, retaining valuable customers and securing a steady revenue stream.

Enhancing financial forecasting

For businesses, especially those with subscription models, the churn rate is a clear indicator of financial health. It allows for accurate revenue predictions and strategic planning, ensuring your business can confidently navigate future challenges and opportunities.

Assessing product-market fit

An increasing churn rate often signals a misalignment between your product and the market’s needs. This insight is crucial for tweaking your product or service to meet customer expectations better, ultimately reducing churn and fostering a more loyal customer base.

How to calculate the churn rate?

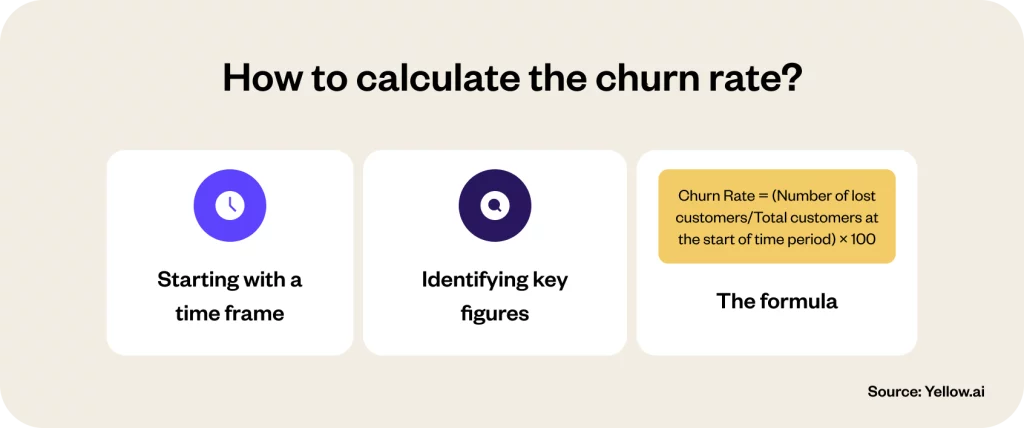

Grasping the churn rate is like unlocking a crucial insight into your business’s heart. It provides a clear view of customer retention’s ebb and flow. This metric, fundamental yet profound, can illuminate the path to sustained business health and growth. Let’s understand the churn rate calculation process, ensuring it’s an accessible tool in your business analysis arsenal.

Starting with a time frame

Begin by pinpointing the timeframe you wish to analyze—be it monthly, quarterly, or annually. This decision frames your analysis and aligns your findings with your business cycles. For instance, an online retail store might opt for a monthly review to monitor fluctuations related to promotional activities or seasonal buying trends closely.

Identifying key figures

The next step involves identifying two pivotal figures: the total number of customers at the beginning of your chosen period and the number of customers who have departed by its end. Imagine starting January with 500 customers and noting 50 unsubscribes by December’s close.

The formula

With these figures at hand, the churn rate calculation becomes straightforward:

Churn Rate = (Number of lost customers/Total customers at the start of time period) × 100

Application: Churn Rate = (50/500) * 100 = 10%

This simple yet powerful formula yields a churn rate of 10%, offering a quantifiable measure of customer retention or loss over the specified period.

Churn rate formula

Understanding the nuances of the churn rate is not limited to knowing how many customers you’re losing. It is about understanding the impact on your business and finding the right strategy to mitigate it. Let’s understand the concept of calculating the churn rate, making it straightforward for any business.

1. Customer churn rate: This basic calculation shows the percentage of customers who leave your service within a specific period. For example, if you start January with 100 customers but end with 90, you’ve experienced a 10% churn rate. It’s a clear indicator of your customer retention performance.

Formula: (Initial customers − End customers)/Initial customers × 100

2. Gross revenue churn rate: This goes a step further by measuring the impact of churn on revenue. It is especially critical for businesses where customer value varies. If your monthly revenue drops by $5,000 from an initial $100,000, your revenue churn rate is 5%. It’s especially useful for subscription models as it provides insight into financial health beyond customer numbers.

Formula: (Lost Revenue/Initial Revenue) × 100

3. Adjusted churn rate: This formula is useful for fast-growing companies. It considers both new sign-ups and those who leave, giving a balanced view of how growth and churn affect your customer base.

Detailed calculations vary, focusing on net change in customer count and considering new acquisitions against churn.

Formula: Number of churned customers during that period / [(Number of customers at the start of the period + Number of customers at the end of the period)/2] * 100 = Adjusted churn rate

4. Seasonal churn rate: This formula helps businesses affected by seasonality understand how churn fluctuates throughout the year. It involves calculating churn rates for busy and quiet periods separately and analyzing them to better plan for seasonal trends.

Adjust your churn rate calculations to reflect seasonal business changes, aiming for a balanced view over the year.

Formula: {[(Total number of customers during bust period + Churn rate during the busy period) + (Total number of customers during slow period + Churn rate during the slow period)]/ (Total number of customers during bust period + Total number of customers during the slow period)}

Pro tip: Segment data to delve deeper into your churn rate insights. It could reveal specific areas for improvement, whether it’s enhancing customer service or tweaking your product offerings. Remember, it’s not just about the numbers; it’s about understanding your customers better and fostering loyalty.

Pelago reimagines customer experience with generative AI powered automation

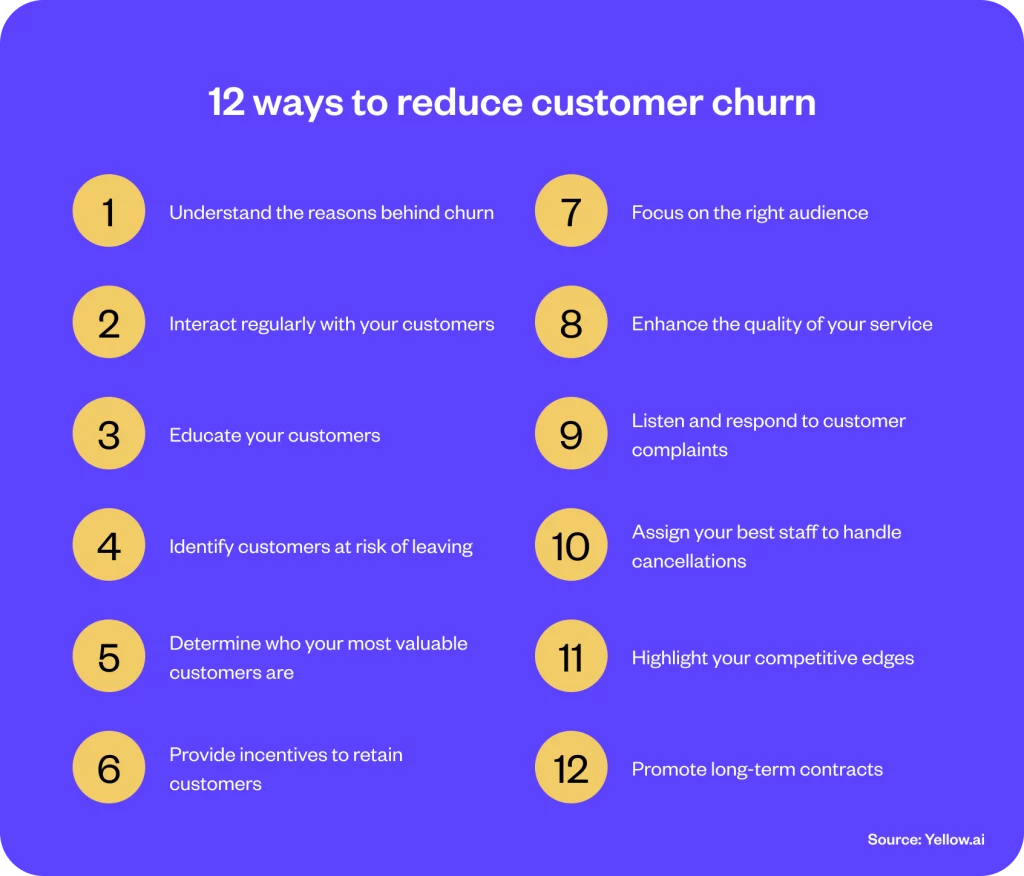

12 Ways to reduce customer churn rate

Creating a strategy to reduce customer churn is vital for sustaining and growing your business. By understanding and implementing effective methods, companies can significantly enhance customer loyalty and overall satisfaction. Here’s a deep dive into 12 actionable strategies to mitigate customer churn.

1. Understand the reasons behind churn

The first step in tackling churn is to grasp why it happens. Direct conversations with departing customers can yield invaluable insights into the improvements your product or service might need. This direct feedback helps you tailor your offerings to better meet customer expectations.

Pro tip: Regularly analyze exit interviews or feedback surveys to detect common patterns or issues leading to churn. Address these systematically to prevent future losses.

2. Interact regularly with your customers

Building a robust relationship with your customers through regular interactions can significantly reduce churn. Whether it’s through newsletters, social media, or personal calls, consistent engagement keeps your brand top-of-mind and demonstrates your commitment to customer satisfaction.

Pro tip: Utilize CRM tools to automate and personalize customer interactions, ensuring timely and relevant communication.

3. Educate your customers

Customers who understand your products’ comprehensive value and functionality are less likely to leave. Providing comprehensive resources like tutorials, webinars, and FAQs empowers users and enhances their experience with your service.

Pro tip: Develop a knowledge base that’s easily accessible and covers common queries and use cases of your product.

4. Identify customers at risk of leaving

Predictive analytics can help identify patterns that signal a customer’s likelihood of churn. By intervening early, you can address their concerns and potentially prevent them from leaving.

Pro tip: Leverage AI and machine learning tools to analyze usage data and predict churn risk.

5. Determine who your most valuable customers are

Recognizing and prioritizing your most valuable customers ensures you retain those who contribute the highest revenue. Tailoring retention efforts towards these customers can yield significant returns.

Pro tip: Segment your customers based on revenue contribution and customize your retention strategies accordingly.

6. Provide incentives to retain customers

Offering discounts, loyalty rewards, or exclusive access to new features can persuade customers to stay. Incentives should be carefully tailored to match customer preferences and behaviors.

Pro tip: Test different incentive strategies to find what works best for different segments of your customer base.

7. Focus on the right audience

It is crucial to attract the right customers in the first place. Customers who see true value in your offerings are less likely to churn.

Pro tip: Refine your marketing and sales efforts to target demographics that best align with your product’s value proposition.

8. Enhance the quality of your service

Continuously improving your product or service based on customer feedback is fundamental. Satisfied customers are loyal customers.

Pro tip: Implement a structured process for collecting, analyzing, and acting on customer feedback.

9. Listen and respond to customer complaints

Addressing complaints promptly and effectively can turn a potentially lost customer into a loyal advocate. Take complaints as opportunities to improve.

Pro tip: Develop a responsive and empathetic customer service team trained to handle complaints constructively.

10. Assign your best staff to handle cancellations

Specialized teams equipped to deal with cancellations can sometimes prevent customers from churning by addressing their specific concerns and offering tailored solutions.

Pro tip: Train these teams in advanced negotiation and empathy techniques to better connect with and retain customers.

11. Highlight your competitive edges

Make sure your customers are aware of what sets you apart from the competition. Understanding the unique benefits of your product or service reinforces its value.

Pro tip: Regularly communicate your achievements, awards, and unique features through various channels.

12. Promote long-term contracts

Encouraging customers to commit to longer-term contracts can reduce churn by giving them more time to realize the value of your service.

Pro tip: Offer pricing or feature incentives for long-term commitments to make them more attractive.

Examples of customer churn rate

Understanding the nuances of customer churn across different industries can provide valuable insights into why customers may decide to leave a service or product. Here are examples of churn rates from various sectors, demonstrating how churn can vary and its implications for businesses:

1. Ecommerce churn rate: Ecommerce businesses can experience churn rates as high as 70 to 80%. However, companies like Wayfair showcase the effectiveness of engaging customer loyalty programs and personalized shopping experiences in maintaining a healthier retention rate, evidencing a 34.5% churn rate in 2020.

2. SaaS churn rate: The SaaS industry operates on a model heavily reliant on subscriptions, making churn rate a critical metric. An ideal benchmark for SaaS companies is to achieve a churn rate lower than the median gross dollar churn of 14%. Netflix, for instance, has managed to keep its churn rate relatively low, though it witnessed an uptick to a 3.3% monthly churn rate in March 2022 following price hikes.

3. Logistics churn rate: The logistics sector sees an average churn rate of around 40%. The key to reducing churn in this industry lies in enhancing customer service and ensuring timely and accurate deliveries to build trust and repeat business.

4. Telecommunications industry churn rates: Due to the industry’s competitive nature and ease of switching providers, telecom companies often observe churn rates of around 1 to 2% monthly. Strategies to combat churn include offering competitive pricing, superior network quality, and excellent customer service.

5. Employment churn rate: The churn rate can also refer to employee turnover within a company. A high churn rate indicates frequent employee departures, which can be costly and disrupt operations. Implementing strong employee engagement, recognition programs, and career development opportunities can help reduce turnover rates.

See the difference in your CX with next-gen AI-powered automation

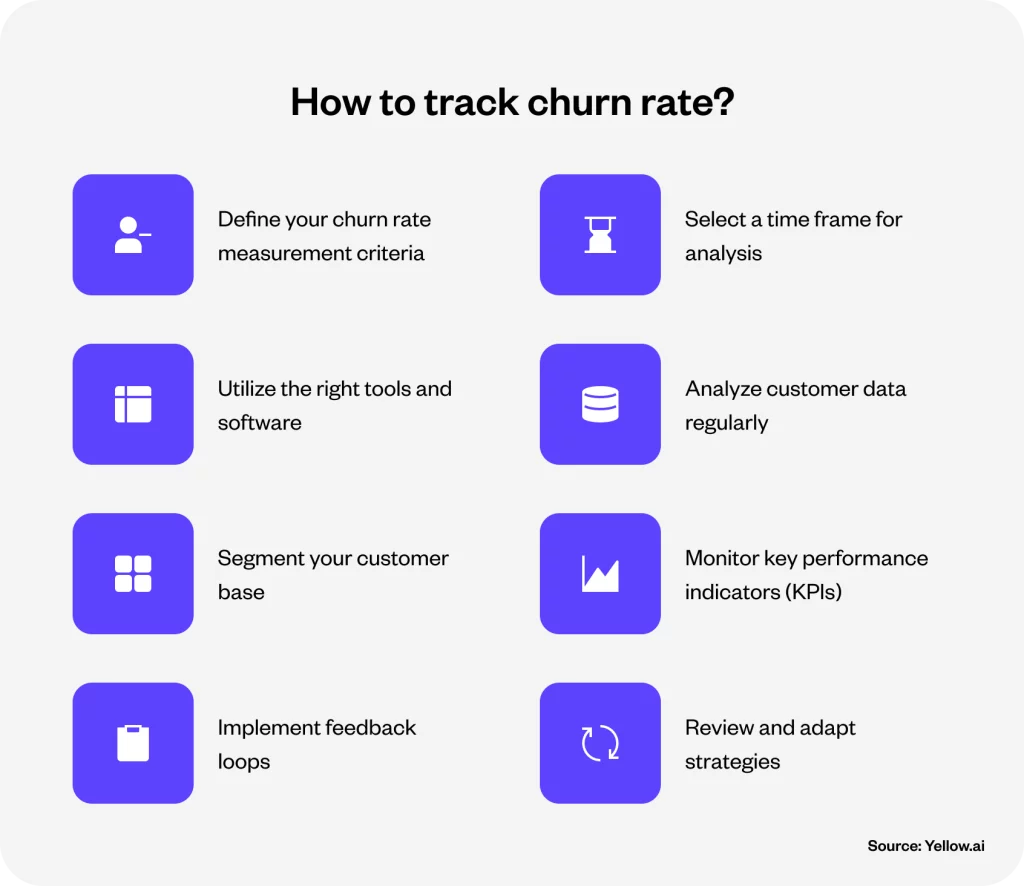

How to track customer churn rate?

Understanding and minimizing customer churn is pivotal for the sustained growth and profitability of a business. Tracking churn rate effectively requires a strategic approach tailored to your company’s unique context and operational framework. Here’s how businesses can systematically track and analyze their churn rate to devise impactful retention strategies:

1. Define your churn rate measurement criteria: The first step is to clearly define what constitutes churn for your business. It could vary significantly across industries and individual business models. Whether it’s subscription cancellations, contract non-renewals, or a decline in active users, having a clear definition is crucial.

2. Select a time frame for analysis: Choose a consistent period, such as monthly, quarterly, or annually, to measure churn. This decision should align with your business cycle and customer usage patterns to ensure accurate and meaningful insights.

3. Utilize the right tools and software: Embrace CRM systems and analytics platforms specifically designed for tracking all facets of customer engagement, including churn. These sophisticated tools streamline the gathering and deciphering of data, offering immediate insights into the patterns and behaviors of your customers.

4. Analyze customer data regularly: Regularly review customer feedback, support ticket trends, and usage data to identify early signs of potential churn. This proactive approach allows you to address issues before they lead to customer departure.

5. Segment your customer base: Break down your customer base into segments based on behavior, product usage, and other relevant criteria. This segmentation allows for a more detailed analysis of churn patterns and enables targeted retention strategies.

6. Monitor key performance indicators (KPIs): Alongside churn rate, track KPIs such as customer satisfaction scores (CSAT), Net Promoter Score (NPS), and customer engagement levels. These metrics can provide additional context and insights into the reasons behind churn.

7. Implement feedback loops: Establish mechanisms to continuously gather and act on customer feedback. It could include surveys, direct customer interviews, and feedback channels within your product or service.

8. Review and adapt strategies: Use the insights from tracking churn to continuously refine your customer retention strategies. This iterative process is essential for staying aligned with customer needs and expectations.

How does Yellow.ai help to reduce customer churn rate?

Customer loyalty is the linchpin of sustainability in modern business dynamics. Reducing the churn rate has become a strategic imperative. Yellow.ai is a frontrunner in harnessing the power of artificial intelligence to enhance customer experiences and foster loyalty. Through its cutting-edge customer service automation by utilizing its advanced AI-driven customer engagement solutions, Yellow.ai offers a suite of tools tailor-made to combat the factors leading to customer churn.

Key features of Yellow.ai in reducing churn rate

- Personalized customer interactions: Handling customer service with a tailored approach for each customer results in better impact. Yellow.ai leverages AI to understand customer preferences, delivering customized interactions that boost engagement and satisfaction, minimizing the chances of customer churn.

- Proactive customer support: In addition to our omnichannel presence across 35+ channels, our AI-powered chatbots and voice agents provide 24/7 support, addressing queries instantly, reducing wait times, and enhancing overall service quality.

- Improved customer service with automation: Through Yellow.ai, you can strike a synergy between AI and human-deliverable customer service. Our futuristic AI can use unique features like sentiment analysis and multilingual human-like responses to attend to customers with minor queries or issues. It unburdens your human customer service agents and lets them handle complex problems more efficiently.

- Data-driven insights: With deep analytics, Yellow.ai identifies at-risk customers, enabling businesses to act swiftly in addressing their concerns.

- Seamless integration: Integrates effortlessly with existing CRM systems, ensuring a unified approach to managing customer interactions across all channels.

Success stories

Hyundai boosts revenue and improves customer service with AI automation

Explore how Yellow.ai’s automation led to ~1000 car sales, a 10% retail conversion rate, and over 1.4 million user impressions

Pelago reimagines customer experience with generative AI powered conversational AI agents

Within a mere six weeks of going live, Pelago not only onboarded over 5,000 users but also achieved a striking 50% deflection rate!

Ready to revolutionize your customer retention strategy? Book a demo with Yellow.ai today and embark on your journey toward minimizing churn and maximizing loyalty.

The final thoughts

Understanding and managing the customer churn metric is more than just a numbers game. It is about crafting experiences that resonate, solving problems before they escalate, and building lasting relationships. In the dynamic dance of business growth, every customer retained is a step forward, a testament to the value you deliver. And while the strategies we’ve discussed lay the groundwork, the journey toward reducing churn is continuous, fueled by innovation, empathy, and a relentless pursuit of excellence.

In this ever-evolving landscape, tools like Yellow.ai stand as beacons of innovation, empowering businesses to transcend traditional boundaries and forge more profound, meaningful connections with their customers. As you move forward, remember that every customer journey is unique, and in these individual stories lie the keys to unlocking greater loyalty and enduring success.

Frequently asked questions (FAQs)

What is the churn rate in customer service?

The churn rate in customer service refers to the percentage of customers who discontinue their relationship with a company over a specific period. It’s a vital metric that indicates the effectiveness of a company’s customer service and retention efforts.

What is the difference between customer churn and revenue churn?

Customer churn measures client loss, whereas revenue churn focuses on income loss due to customer exits. Revenue churn is particularly critical for businesses where customer value varies significantly.

What is the difference between customer churn and gross churn?

Customer churn typically refers to the loss of clients, while gross churn delves into the monetary impact, considering the total revenue lost due to customer churn without offsetting for new or expanded revenue.

What is a good customer churn rate?

A reasonable customer churn rate varies by industry, but as a rule of thumb, a rate of 5-7% annually is generally considered acceptable. Lower rates are always better, indicating strong customer loyalty and retention strategies.

What is a good churn rate for B2C?

For B2C companies, an acceptable annual churn rate is often around 5-7%. However, this can vary depending on the sector and subscription model. The goal should always be to strive for the lowest possible churn rate.