Understanding and optimizing Customer Acquisition Cost (CAC) is beyond just beneficial—it’s vital. As businesses continually seek avenues for sustainable growth, managing and reducing CAC emerges as a primary objective. This article delves deep into the nuances of CAC, underscoring its pivotal role in ensuring profitability. Through a curated list of eight sophisticated strategies, we guide businesses on tactically reducing their CAC. Furthermore, we spotlight the transformative potential of Yellow.ai in supercharging these efforts, positioning it as a game-changing ally for businesses in the digital age.

Boardroom meetings, quarterly reviews, and strategy sessions invariably circle back to one pivotal question – ‘What’s our cost to bring a new customer on board?’ If you’re nodding in agreement, you’re not alone. For the astute leaders of major companies worldwide, understanding the Customer Acquisition Cost (CAC) is akin to holding the pulse of the business.

CAC is the metric that reveals the monetary impact of that brand conversation. It is the heartbeat of sustainable growth. After all, it helps businesses determine the assets they will require to draw in new consumers while being profitable. Whether you’re at the helm of a burgeoning tech startup, a retail giant, or an enterprise offering cutting-edge solutions, getting a grip on your CAC can make or break your strategy.

Ready to dive into the world of CAC? Let’s get started!

What is customer acquisition cost?

Imagine rolling out an expansive marketing campaign. You’ve got online advertisements, content marketing strategies, social media promotions, and perhaps even a captivating webinar or seminar in the mix. Every dollar you pour into this effort aims to convert the target audience into loyal customers. In essence, the customer acquisition cost (CAC) quantifies this venture.

To break it down, CAC represents the total expenditure a business commits to attract and secure a new customer. It encapsulates direct marketing costs, ad spends, promotional events, and even the indirect costs associated with marketing and sales teams—salaries, commissions, bonuses, and overheads.

However, it’s crucial to distinguish CAC from another significant metric, the Customer Lifetime Value (CLV or LTV). While CAC sheds light on the cost incurred to bring in a new customer, CLV calculates the anticipated revenue from a single customer across the entirety of their relationship with the business.

While both metrics can be assessed independently, pairing CAC with LTV offers a panoramic view of your business’s health. Their combined insight allows businesses to measure the efficacy of their marketing efforts against the projected revenue from the newly acquired clientele.

How to calculate customer acquisition cost?

Crunching numbers might not be everyone’s cup of tea. Still, when it comes to gauging the health of your business, there’s no escaping the math, especially when those numbers can reveal the cost efficiency of your sales and marketing strategies.

Step-by-step guide to calculating customer acquisition cost CAC

Here’s a step-by-step guide to simplify the process:

Step 1: Set your time frame

Before diving into calculations, decide on the period you want to evaluate: monthly, quarterly, or annually. Not only does this decision frame your dataset, but it also provides context when benchmarking against industry standards.

Step 2: Get down to the math

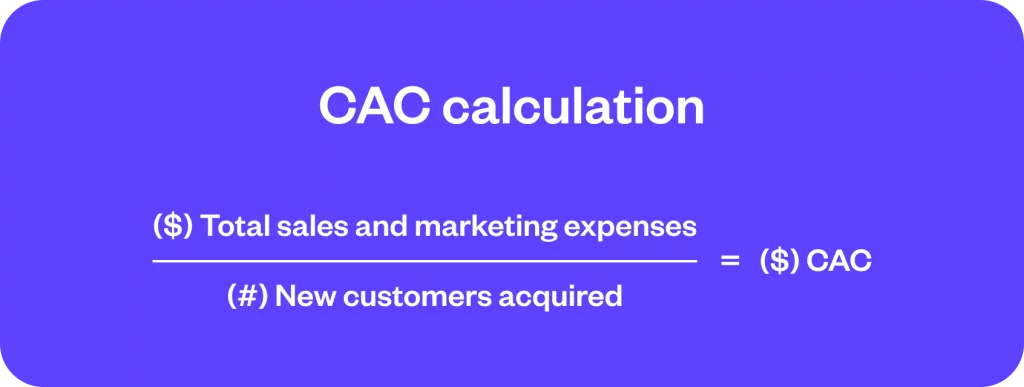

To compute your CAC, sum up all the expenses related to sales and marketing during your chosen time frame. Next, divide that total by the number of new customers you’ve garnered within that period. This quotient is your CAC.

The formula, in a nutshell, looks like this:

Dive deeper: The paid CAC formula

Beyond the general CAC, there’s a more nuanced metric: Paid CAC. It is particularly useful for businesses that want to assess the impact of their paid promotional endeavors. By sidelining salaries and overheads, this metric exclusively zeroes in on the costs and outcomes of paid campaigns.

So, if a potential customer clicks on that irresistible Facebook ad or gets drawn in by a sponsored Google search, this formula is your go-to:

Paid CAC = Sales and marketing expenditure (excluding salaries and overheads) / New customers acquired via paid channels

These formulas can help evaluate the monetary efficiency of your outreach, fine-tune strategies, and, ultimately, optimize returns.

What to include in a customer acquisition cost (CAC) calculation?

Determining the Customer Acquisition Cost goes beyond tallying the obvious numbers on your advertising bill. It’s about aggregating various expenses that facilitate the customer’s journey from awareness to conversion. To ensure a comprehensive CAC calculation, it’s vital to include all pertinent costs:

- Salaries: Compensation for your sales and marketing teams, driving the customer acquisition process

- Operational resources: Equipment essential for your sales and marketing activities, such as computers, phones, printers, and other related infrastructure.

- Digital tools: CRM systems, marketing automation platforms, and other technological utilities pivotal to contemporary acquisition strategies

- External collaborations: Fees associated with third-party consultants, marketing agencies, or creative freelancers

- Advertising expenditure: Costs associated with online ads on search engines, social media, and even traditional forms of advertising.

- Event sponsorships: Expenses for conferences, seminars, and other events aimed at brand visibility and lead generation.

- Discounting strategies: Price incentives or discounts given to attract customers. Though effective, they contribute to the acquisition cost.

By capturing the entire spectrum of your investment in the customer acquisition journey, businesses can get an accurate reflection of their acquisition expenses and make informed strategic decisions.

Why is customer acquisition cost (CAC) so critical to business success?

Every business metric, including CAC, offers insights that help companies navigate their journey toward success. As time progresses, the significance of CAC becomes increasingly evident. Furthermore, a keen understanding of CAC can provide a distinct advantage in a competitive landscape.

Let’s delve deeper into three primary reasons why grasping your CAC is paramount for your business.

Achieving an ideal LTV/CAC ratio

At the heart of a SaaS or subscription-based enterprise lies its focus on the customer. To thrive, you must attract customers cost-effectively and retain them for extended periods. The LTV-CAC Ratio acts as a barometer, ensuring your business is on the right track.

Ideally, this ratio should stand at 3:1, indicating that you earn three in return for every dollar spent on acquisition. If your LTV/CAC falls below 3, it’s a clarion call to revisit and perhaps reduce your marketing expenses, ensuring the longevity of profitable acquisition initiatives.

Prioritizing the payback period

Once you onboard a new paying customer, the immediate goal shifts to recouping the acquisition expenditure. Think of the payback period as an extension of CAC that offers granular insights into acquisition efficacy.

Occasionally, you may not get back the money you have invested. For instance, many of your users never become paying customers. Or consumers may leave before you break even. Therefore, SaaS businesses want to recover their money as soon as possible. A 12-month payback period is a solid target.

Monitoring and refining the CAC ratio

Especially for startups, consistently evaluating and fine-tuning the CAC is a linchpin for sustained growth and profitability. CAC is not static; it varies based on industry, business model, and target demographics. Benchmarking your CAC against competitors and industry norms is essential.

To determine if your customers are providing a positive or negative return on investment (ROI), you must first calculate your CAC and LTV. Then, you can compare those results. A greater ratio denotes a more profitable and long-term business strategy.

How to analyze your customer acquisition cost (CAC)?

For a nuanced understanding of CAC, one must evaluate it across different client categories, marketing channels, and product lines:

- Initial CAC: Reflects the cost of first-time customer acquisition

- Reactivation CAC: Calculates the cost of bringing back previous or lost consumers

- Renewal CAC: This looks into the cost of retaining a customer, broken down further by first-time renewals, second-time renewals, and so on.

- Market CAC: Determines the cost of acquiring customers within specific markets, such as a particular country, region, or business sector

- Customer CAC: Focuses on the cost of acquiring customers based on specific demographics, such as age, gender, profession, or even past engagement levels

- Product CAC: Captures the cost of procuring a customer for a specific product or service

- End-users CAC: Considers the cost of gaining customers by the number of users their license permits. Here, costs are divided by the total end-users instead of individual contracted customers.

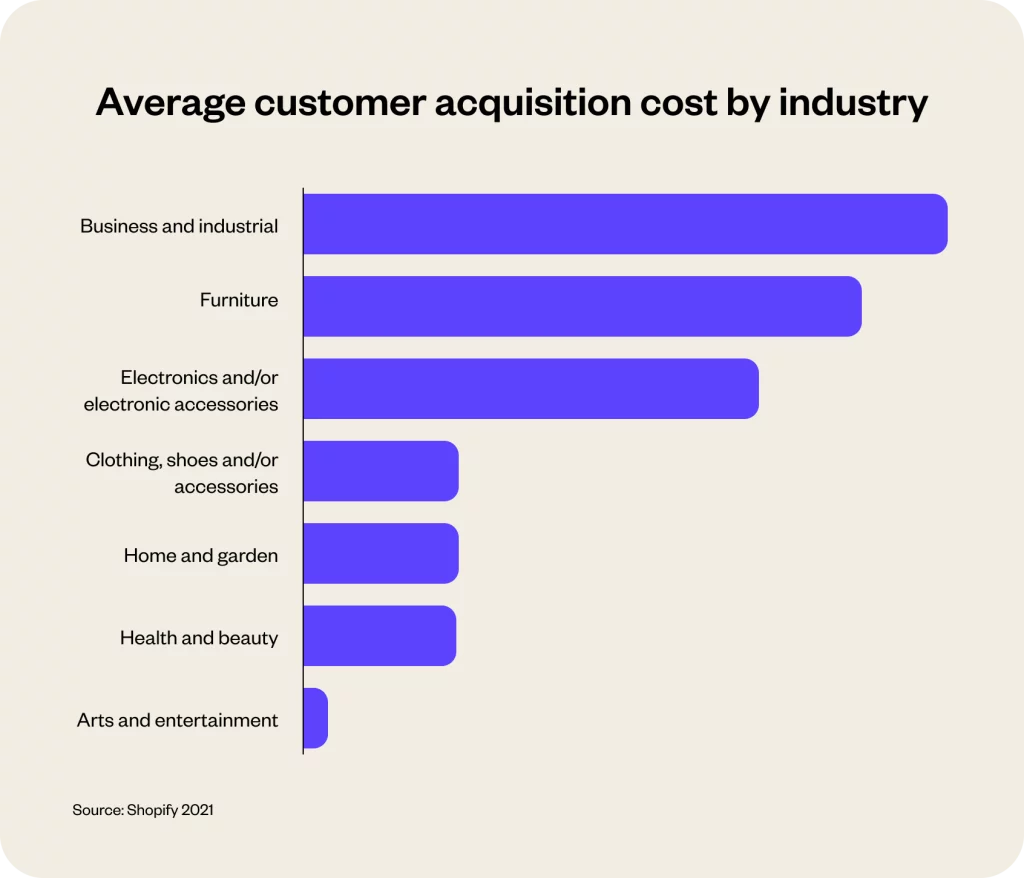

What is the average customer acquisition cost (CAC) by industry?

Average customer acquisition cost for SaaS

The average CAC in the North American SaaS market typically spans from $1,000 to $5,000 or more per customer. This range accounts for all acquisition-related costs like marketing, advertising, sales team compensation, and essential software tools.

Due to intricate sales cycles, high-tier SaaS companies catering to major organizations might witness a higher CAC. On the other hand, those serving small to medium businesses might register a lesser CAC, thanks to a more direct sales process.

Market dynamics, competition, and shifts in marketing strategies can change these numbers.

Average customer acquisition cost for B2B businesses

Companies offering straightforward services, like some SaaS solutions or essential business services, often record a CAC ranging from $500 to $5,000 per customer. However, the CAC can hover between $5,000 and $20,000 for sectors like professional services or specialized software solutions.

In sectors with highly complex sales processes and longer sales cycles, like enterprise software or industrial equipment, the CAC can be significantly higher, often exceeding $20,000 and reaching six figures for large enterprise deals.

Average customer acquisition cost for e-commerce businesses

Emerging e-commerce setups or niche brands may observe a CAC between $10 to $50, leveraging organic traffic, social media, and emails. Meanwhile, more established e-commerce entities might record a CAC between $50 and $200, deploying strategies like paid ads, SEO, and email marketing.

Major e-commerce players, especially those in fiercely competitive environments, can register a CAC beyond $200. Enterprise-level e-commerce ventures catering to diverse audiences with a vast product portfolio might even report CACs exceeding $500.

Special note

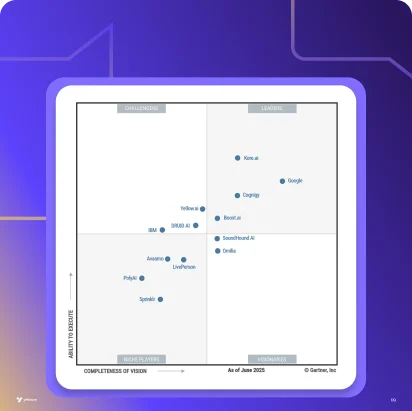

AI technologies are increasingly becoming a cornerstone in optimizing customer acquisition strategies. Solutions like Yellow.ai, with their focus on AI-driven chatbots, enable enhanced customer interaction, resulting in more effective engagement. Personalization through AI ensures targeted advertising, while predictive analytics and dynamic pricing boost conversions. The AI-powered approach refines operations and significantly reduces the CAC across SaaS, e-commerce, and B2B businesses.

8 Ways to reduce your customer acquisition cost

Finding strategic ways to reduce CAC is pivotal for the longevity and profitability of your business. Here are eight savvy approaches that you can follow to minimize customer acquisition costs in 2023.

1. Understand what customers want

Developing in-depth buyer personas, which encapsulate the needs and pain points of your market, is crucial. Yellow.ai extends a hand with a free template designed to facilitate the creation of detailed buyer personas, offering a structured approach to better comprehend and target your audience.

2. Identify the target audience

Use customer segmentation and buyer personas to define your Ideal Customer Profile (ICP). This step ensures you focus your efforts and resources on the audience likely to become high-LTV consumers.

For example, if customers from your newsletter convert more favorably than those from social media, you can adjust your acquisition strategy accordingly.

3. Minimize customer churn

By keeping a finger on the pulse of your customer base to identify and understand possible churn, you safeguard against unnecessarily elevated marketing expenditures. The analytics capabilities of Yellow.ai empower businesses to meticulously track customer behaviors, offering a chance to address potential issues preemptively.

4. Trim down the sales cycle

A lengthy sales cycle can drain resources. Streamline and optimize your sales process using automation and identify and eliminate inefficiencies.

Streamlining the sales process is pivotal for reducing CAC. With Yellow.ai’s advanced conversational AI, businesses can swiftly address complex customer concerns and ambiguities, ensuring a smoother transition from a prospect to a committed customer.

By navigating intricate customer queries intelligently, the chatbot offers timely solutions and reduces the time and resources spent on repetitive or unresolved issues, leading directly to cost savings.

5. Reach customers on their preferred channels

While paid channels can have reasonable conversion rates, they can also be expensive. Channeling investments towards organic reach can reduce dependency on potentially pricier paid channels.

Yellow.ai’s chatbots, deployable on omnichannel platforms including Facebook and WhatsApp, meet customers in their preferred digital spaces, enhancing accessibility and user experience.

6. Ask current customers for referrals

While leveraging the power of satisfied customers, employing conversational AI to streamline and even automate referral request processes can optimize this word-of-mouth engine without adding to the operational workload.

Harness the trust you’ve built with your existing customers and encourage them to become brand advocates.

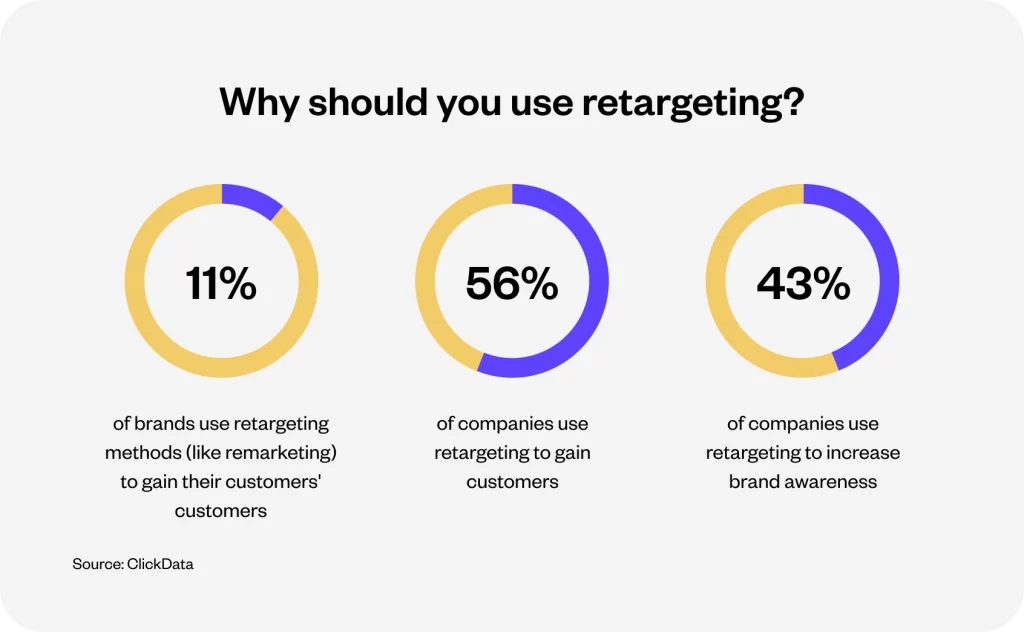

7. Implement retargeting strategies

Retargeting campaigns can persuade potential customers to reconsider their decisions. Collect and analyze customer data to create effective retargeting strategies.

Yellow.ai can become a vital tool in precision retargeting, with its ability to assimilate and analyze customer behaviors and preferences, allowing your retargeting campaigns to be fine-tuned and more aptly resonate with the intended audience.

8. Increase average purchase value

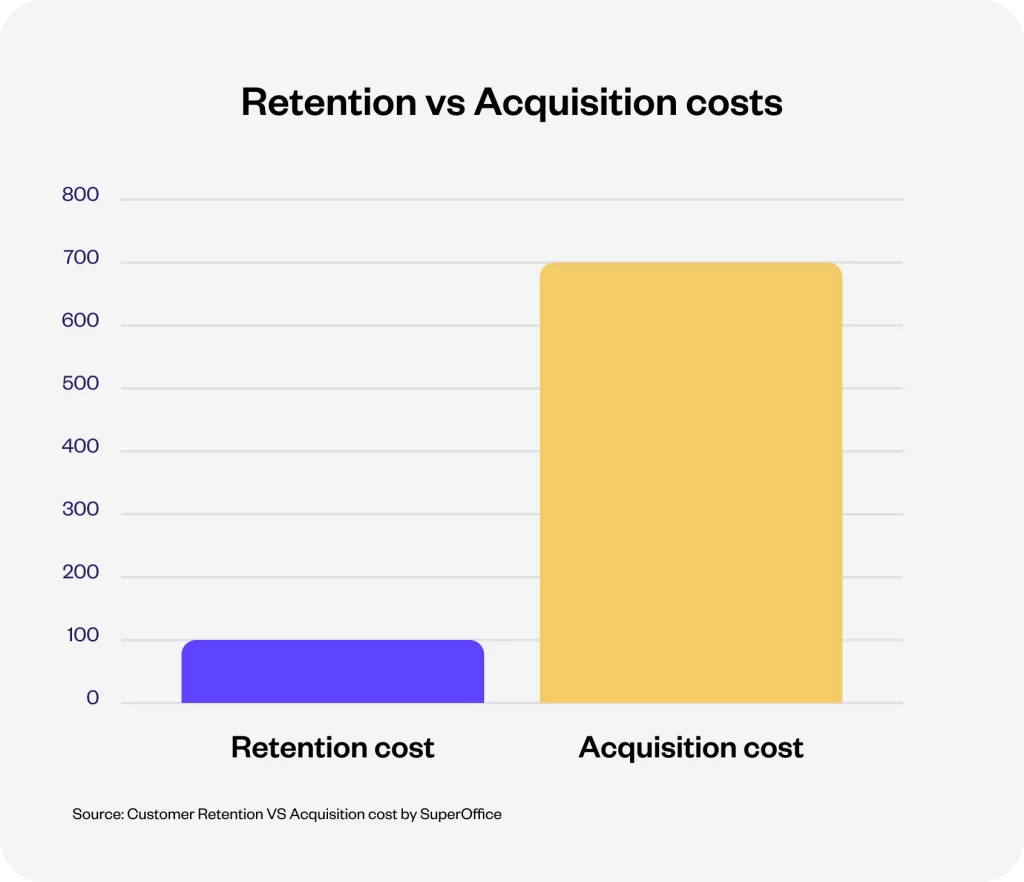

While enhancing your strategies to nudge existing customers towards higher-value purchases, balancing the focus between customer acquisition and retention becomes paramount. So, rather than focusing solely on acquiring new customers, aim to increase the average order value from existing customers.

How Yellow.ai enhances CAC reduction strategies

Automated lead qualification

Yellow.ai’s chatbots do more than automate initial interactions; they ensure that your sales team concentrates on high-potential leads. For instance, banking institutions can utilize Yellow.ai to inquire about credit scores and evaluate nuanced responses, analyze multi-faceted credit risks, and provide instant, tailored loan recommendations.

Personalized engagement

AI-driven personalized engagement means more than tailored content. An e-commerce platform using Yellow.ai could predict emerging trends based on intricate buying behaviors, integrating with inventory systems to recommend products that align with customer preferences and stock optimization.

Round-the-clock sales assistance

Yellow.ai virtual assistants provide continuous support, answering queries and guiding potential customers. For instance, insurance companies can use Yellow.ai to recommend plans and monitor changes in a client’s situation, proactively suggesting plan adjustments as needed.

Omnichannel customer interactions

Yellow.ai ensures that brands connect with potential customers wherever they are most comfortable, but the depth of this engagement stands out. For instance, retail brands can leverage Yellow.ai to support customers on platforms like WhatsApp, web chat, and voice assistants and provide contextually relevant interactions in over 135 languages.

Insightful, data-driven decisions

Yellow.ai’s analytical capabilities ensure that businesses make data-driven decisions. Consider a telecom company using Yellow.ai: Beyond identifying the most effective marketing channels, they could predict emerging market trends, helping to refine future acquisition strategies.

Conclusion: Unlock sustainable growth with smart CAC management

Navigating the intricacies of customer acquisition costs doesn’t have to be daunting. Armed with robust data, innovative technologies, and intelligent strategies, businesses can effectively manage and reduce their CAC. With Yellow.ai at the intersection of technology and strategy, businesses gain a formidable ally. Their AI-driven solutions enhance customer interactions, personalize engagement, and ensure efficient customer acquisition investment.

Ready to optimize your customer acquisition strategies with unparalleled precision and intelligence? Connect with Yellow.ai today and commence a journey where every customer acquired is a step towards seamless, sustainable growth.

How to calculate CAC?

CAC is determined by dividing the total costs associated with sales and marketing by the number of new customers acquired during a specific period.

What is the CAC customer acquisition formula?

Certainly. Customer Acquisition Cost (CAC) = Total sales and marketing expenses ÷ Number of new customers acquired.

What are CAC and LTV?

CAC stands for Customer Acquisition Cost, representing the total cost to acquire a new customer. In contrast, Lifetime Value (LTV) measures the average revenue a customer contributes during their association with your business. The LTV:CAC ratio helps gauge a customer’s value against the acquisition cost.

What is the difference between CPA and CAC?

While CPA (Cost Per Acquisition) and CAC (Customer Acquisition Cost) may seem alike, they cater to different scopes. CPA focuses on the cost of acquiring a new customer from a specific campaign or conversion, whereas CAC encompasses the broader expense of gaining and retaining a customer.

How to determine which metrics to include in the CAC?

The primary components of CAC include all expenses related to sales and marketing aimed at attracting customers and the resultant number of customers secured.

Why is understanding CAC essential?

CAC offers insights into the cost-effectiveness and potential profitability of your growth strategies. If CAC significantly exceeds LTV, your growth might not be sustainable, as the expense to procure a customer surpasses the profit they generate.